Hello frinds , I know you are confuse and try to understand the differnce between life insurance & health insurance and which is best for you and your family. In today’s unpredictable world, where the future is uncertain, the need for financial security has become more important than ever. Most people know they need some form of insurance, but they often get confused between life insurance and health insurance. Both are critical in their own ways, but they serve different purposes. So, how do you decide which one is right for you? Let’s dive into the differences, their benefits, and why having both might be essential for your financial safety net.

What is Life Insurance?

Life insurance is a promise of financial support for your family in case of your untimely death. Imagine you are the main earner in your household, and suddenly you’re no longer there to provide for them. How will they manage daily expenses, loans, or your children’s education?

According to a report by the Life Insurance Council of India, nearly 70% of Indian families without life insurance face financial difficulties after the loss of the primary breadwinner. Life insurance steps in by providing a lump sum payout to your family, ensuring their financial stability even in your absence.

What is Health Insurance?

On the other hand, health insurance is like a protective shield for you and your family against high medical costs. With the rising expenses in the healthcare industry, a single hospitalization could set back your savings by lakhs. Health insurance helps cover these costs, allowing you to receive medical treatment without worrying about finances.

Data from the National Health Portal reveals that over 60% of Indian families end up using their savings for medical emergencies. Health insurance steps in to cover hospitalization, surgeries, and even critical illnesses.

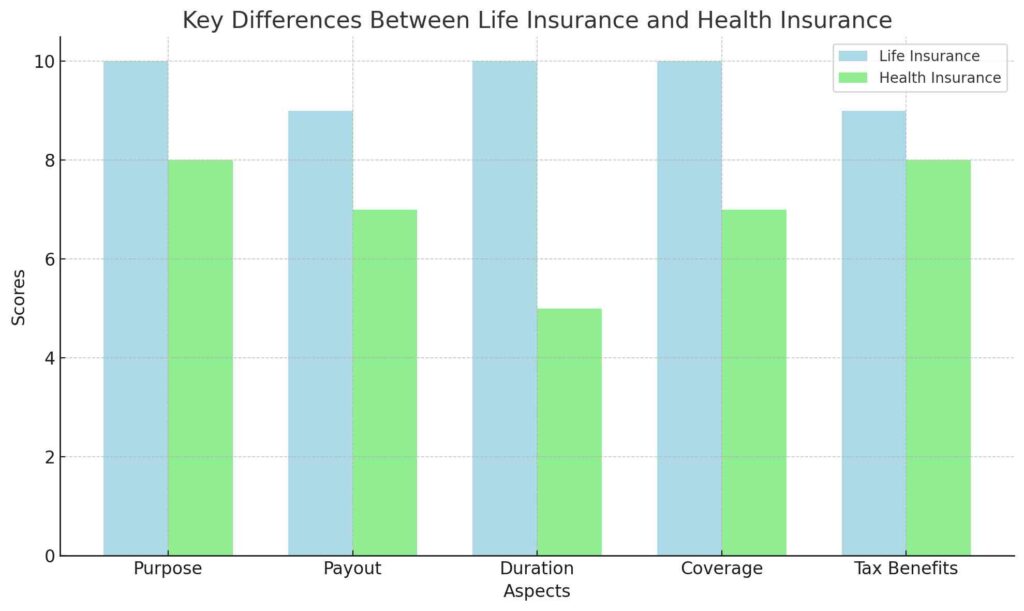

Key Differences Between Life Insurance and Health Insurance

When it comes to choosing the right insurance policy, understanding the key differences between life insurance and health insurance is crucial. Both serve different purposes, and knowing these distinctions will help you make an informed decision. Let’s break down the differences with the help of data.

- Purpose: Life insurance provides financial security to your family in case of your untimely death. It’s a long-term investment that helps your loved ones maintain their lifestyle after you’re gone. On the other hand, health insurance covers your medical expenses during your lifetime, protecting your savings from high hospital bills.

- Payout: The payout for life insurance is a lump sum amount paid to the nominee after the death of the policyholder. In contrast, health insurance offers reimbursement or cashless payments for hospitalizations, surgeries, and treatments during the policyholder’s life.

- Duration: Life insurance policies are typically long-term and can last anywhere from 10 to 30 years or even more. Health insurance is usually renewed annually, and coverage must be maintained every year to stay protected.

- Coverage: Life insurance policies provide a large sum assured, often ranging from ₹20 lakh to ₹1 crore, based on the family’s financial needs. Health insurance coverage varies depending on the plan, ranging from ₹2 lakh to ₹50 lakh for medical expenses.

- Tax Benefits: Both types of insurance offer tax benefits, but they fall under different sections of the tax code. Life insurance premiums qualify for Section 80C deductions, while health insurance premiums can be deducted under Section 80D.

Who Should Choose Life Insurance?

If you’re someone with dependents—whether it’s your spouse, children, or aging parents—life insurance should be your top priority. According to IRDAI, more than 75% of working professionals in India have some form of life insurance to protect their families. Life insurance ensures that even if you’re not around, your family won’t face financial struggles.

For example, imagine Rajesh, a 35-year-old working in Lucknow, who has a wife and two children. His monthly income supports the household expenses and a home loan. If Rajesh suddenly passes away, his family would not only face emotional loss but also financial devastation. But with a life insurance policy of ₹1 crore, his family can continue paying off the home loan and manage future expenses without stress.

Who Should Choose Health Insurance?

Health insurance is a must for everyone, regardless of age or lifestyle. Medical emergencies don’t come with a warning. Whether it’s a sudden accident, a heart surgery, or the diagnosis of a critical illness, health insurance ensures that these expenses don’t drain your savings.

Let’s take the case of Pooja from Delhi, who thought she didn’t need health insurance because she was young and healthy. But after being diagnosed with dengue and requiring hospitalization, her family ended up paying ₹75,000 from their savings. A simple health insurance plan could have covered the entire amount.

Why Both Life Insurance and Health Insurance Are Essential

Now, you might ask, “If I have life insurance, do I still need health insurance?” The answer is yes. Life insurance and health insurance serve completely different purposes. Having both ensures that you are covered in every possible scenario—whether it’s an untimely death or an unexpected hospitalization.

According to a study by the Insurance Regulatory and Development Authority of India (IRDAI), families with both life and health insurance are 40% more financially secure than those with just one type of insurance. Health insurance keeps your medical costs in check, while life insurance guarantees your family’s long-term financial security.

How to Select the Right Insurance Policy for Your Needs

Choosing between life insurance and health insurance isn’t an either-or situation. It depends on your financial goals, your family’s needs, and your health risks. Here are some data-backed tips to help you decide:

- Assess Your Financial Responsibilities:

If you have a home loan, children’s education fees, or any other long-term financial commitments, life insurance is critical. A general rule of thumb is to get a life insurance policy that covers 10-15 times your annual income. - Evaluate Your Health Risks:

If you or your family has a history of medical issues, it’s essential to have health insurance. Medical costs for critical illnesses have increased by 30% in the last five years. A health insurance policy with at least ₹10-15 lakh coverage can save you from unexpected expenses. - Balance Both:

Ideally, you should aim to have both types of insurance. Start with a basic health insurance plan and a life insurance policy that offers sufficient coverage for your family’s future needs.

Important Factors to Consider When Choosing an Insurance Policy

- Claim Settlement Ratio:

The claim settlement ratio of an insurance provider is crucial. IRDAI data shows that companies with a settlement ratio above 90% are more reliable. - Exclusions:

Read the fine print to understand what is excluded in your policy. For example, most health insurance policies have a waiting period for pre-existing conditions. - Premium Affordability:

While it’s important to get adequate coverage, the premium should also fit within your budget. Balance your premium and coverage needs carefully.

Common Mistakes People Make When Choosing Insurance

- Underestimating Coverage:

Many people choose minimal coverage to save on premiums. However, this can backfire during a claim. It’s better to pay a slightly higher premium for sufficient coverage. - Not Updating Nominee Information:

Life insurance policies often require you to list a nominee. Make sure to update your nominee after life events like marriage or the birth of a child to avoid complications during claims.

FAQs

- Rajiv from Mumbai asks: What happens if I outlive my life insurance policy term?

Answer: If you outlive your term insurance policy, the coverage ends, and you don’t get any benefits unless you’ve chosen a return of premium plan. - Sneha from Bangalore asks: Can I have both life insurance and health insurance at the same time?

Answer: Yes, it’s advisable to have both. Life insurance protects your family after your death, while health insurance covers medical expenses during your life. - Ravi from Delhi asks: How much life insurance coverage should I get?

Answer: Ideally, your life insurance coverage should be 10-15 times your annual income. This ensures your family can maintain their lifestyle in your absence. - Anjali from Jaipur asks: Does health insurance cover pre-existing conditions?

Answer: Most health insurance policies cover pre-existing conditions after a waiting period of 2-4 years. - Arun from Chennai asks: Can I get tax benefits on both life and health insurance?

Answer: Yes, life insurance premiums are tax-deductible under Section 80C, and health insurance premiums under Section 80D. - Sunita from Lucknow asks: What’s the difference between critical illness and health insurance?

Answer: Health insurance covers general medical expenses, while critical illness insurance covers specific life-threatening conditions like cancer or heart attacks.If you are searching Health insurance agent or Life insurance agent in Lucknow then once you should consider Insurance Baba – Insurance agent in lucknow - Deepak from Kolkata asks: Can I buy a health insurance policy for my parents?

Answer: Yes, many companies offer senior citizen health insurance policies tailored for older adults. - Vikas from Hyderabad asks: What is the waiting period in health insurance?

Answer: The waiting period is typically 2-4 years for pre-existing diseases, during which they won’t be covered. - Renu from Pune asks: What happens if I miss paying a premium?

Answer: Missing a life insurance premium could lead to the policy lapsing. Health insurance will become inactive if you miss the premium payment. - Amit from Noida asks: Can I increase my life insurance coverage later?

Answer: Yes, most insurers allow you to increase coverage during life events like marriage or having children.

Conclusion: Ensuring Complete Financial Security for Your Family

At the end of the day, choosing between life insurance and health insurance isn’t about “either-or.” Both of these policies serve completely different, but equally crucial, purposes in your life. Life insurance is like a safety net for your family—if something unexpected happens to you, they won’t be left in financial despair. On the other hand, health insurance ensures that medical bills don’t become a financial burden while you’re still around to handle them.

Imagine this: If you’re the primary earner, your sudden absence could cause chaos not only emotionally but also financially. And what if a sudden health emergency drained your savings? These aren’t just hypothetical situations—they happen to families every day. But with the right mix of life and health insurance, you can protect your family from these scenarios.

So, what’s the right policy for you? The answer lies in your personal circumstances. Do you have dependents? Do you have financial obligations like loans or children’s education to think about? Then life insurance is your shield. Are you worried about rising medical expenses? Health insurance will be your armor. In reality, both should be part of your financial plan.

By combining both types of insurance, you’re creating a strong, secure future for yourself and your loved ones. Remember, it’s not just about money—it’s about peace of mind, knowing that no matter what happens, you’ve taken the right steps to protect what matters most.

Buy Best life Insurance Plan and Policy Online in India 2024