Understanding the Role of Insurance in Risk Management is crucial in today’s unpredictable world. We all face risks in life, whether it’s the sudden need for medical care, an unexpected accident, or a natural disaster impacting our property. Insurance provides a safety net, transferring the financial burden of these risks from you to the insurance company. This role becomes especially important when you think about how one incident could derail financial stability for years.

When you understand how insurance works in risk management, it empowers you to make informed choices for protecting your family, health, and assets. By paying a small, predictable premium, you avoid the potential for huge losses. Throughout this article, we will explore how insurance minimizes financial uncertainty, covers unexpected losses, and brings peace of mind in the face of life’s uncertainties.

1. What Is the Role of Insurance in Risk Management?

The role of insurance in risk management involves transferring the financial burden of potential losses from an individual or business to an insurance company. By paying premiums, policyholders secure coverage for risks like medical emergencies, property damage, or liability claims. This helps mitigate financial hardship and provides stability in unpredictable situations, making insurance an essential component of any risk management strategy.

2. How Insurance Protects Against Financial Losses

Insurance plays a crucial role in risk management by protecting individuals and businesses from unexpected financial setbacks. For instance, if a natural disaster damages your home, your homeowner’s insurance policy can cover repair costs, saving you from a large out-of-pocket expense. This proactive approach helps ensure financial security even in the face of sudden losses.

3. Understanding Different Types of Insurance for Risk Management

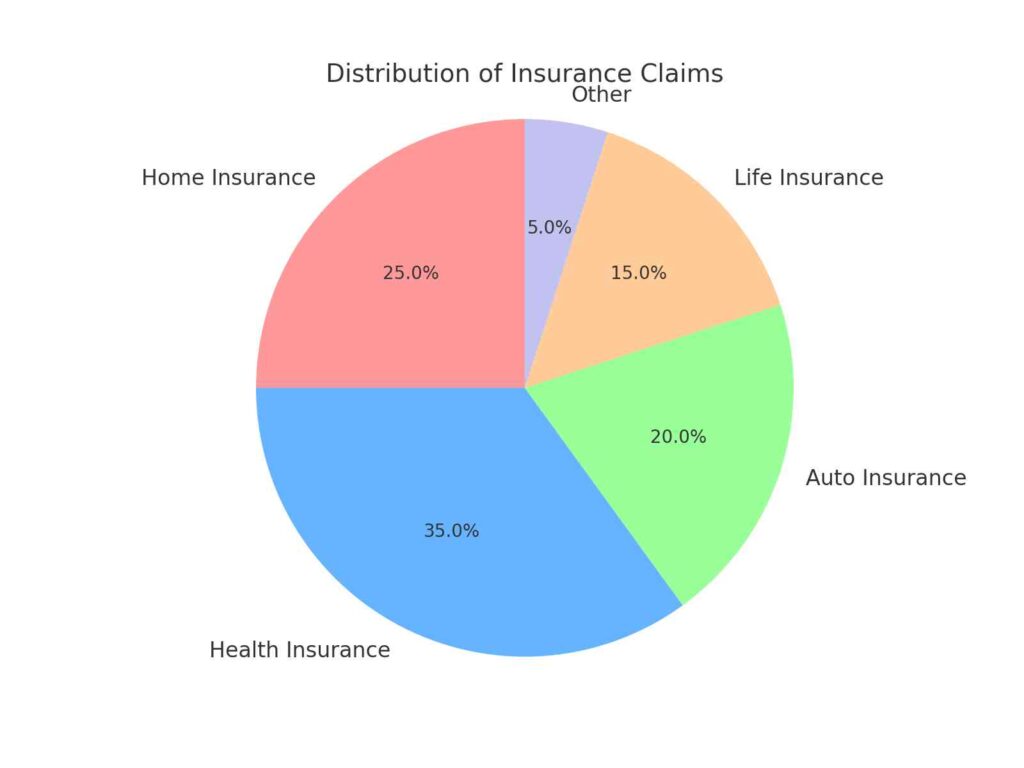

Different types of insurance address various risks, such as health, life, property, and liability insurance. Each type serves a specific role in risk management. For example, health insurance covers medical costs, while auto insurance handles vehicle-related damages or accidents. Understanding these types helps you choose the right coverage to safeguard against possible threats.

4. Why Businesses Rely on Insurance for Risk Mitigation

For businesses, the role of insurance in risk management is to safeguard against operational and financial disruptions. Business insurance can cover losses due to property damage, lawsuits, or employee injuries. By managing these risks through insurance, companies can focus on growth and stability, knowing they have a financial backup in case of crises.

5. Personal Insurance: Managing Everyday Risks

Personal insurance, like health, auto, and home insurance, helps individuals manage everyday risks. The role of insurance in risk management at a personal level ensures that unforeseen events, like a car accident or a medical emergency, do not derail your financial plans. It provides peace of mind and a structured approach to handle life’s uncertainties.

6. How Insurance Supports Long-Term Financial Planning

Insurance is a vital part of long-term financial planning. The role of insurance in risk management extends to helping families secure their financial future. For example, life insurance can provide financial support to your loved ones in case of an untimely death, covering expenses like mortgages and education fees. This ensures that financial goals are protected even in the worst-case scenarios.

7. The Role of Reinsurance in Managing Large-Scale Risks

Reinsurance is the process through which insurance companies protect themselves from massive claims. It plays a significant role in risk management by spreading the financial risk among multiple insurers. This system ensures that insurance companies remain solvent even after major events, like natural disasters, enabling them to pay out claims and continue providing coverage.

8. How to Assess Your Insurance Needs for Better Risk Management

Understanding the role of insurance in risk management involves assessing your personal or business risks and choosing appropriate coverage. Consider factors like your health, property value, business operations, and lifestyle to determine the types of insurance you need. This evaluation ensures you’re not underinsured and that you have adequate protection for various scenarios.

9. The Impact of Risk Management Strategies on Insurance Premiums

Your risk management strategies can directly impact your insurance premiums. For instance, installing security systems in your home or practicing safe driving can lower your insurance costs. The role of insurance in risk management includes incentivizing policyholders to minimize risks, which, in turn, can make premiums more affordable.

10. How Insurance Provides Peace of Mind in Risk Management

Perhaps the most valuable role of insurance in risk management is the peace of mind it offers. Knowing that you have financial protection in place allows you to live and work without constant worry about unforeseen events. Whether it’s protecting your family’s future or your business’s assets, insurance gives you confidence that you are prepared for life’s uncertainties.

FAQ Section:

- Question: Ankit from Lucknow asks: “How does insurance actually reduce financial risks for a small business owner like me? Will it cover all possible damages?”Answer: Insurance reduces financial risks for small business owners like you by providing coverage for unforeseen events, such as property damage, liability claims, or employee injuries. For example, if a natural disaster damages your office, a commercial property insurance policy will help cover repair costs. However, it’s important to understand that no policy covers all possible damages. Policies have exclusions and limits, so reviewing your specific coverage with an insurance advisor ensures you have adequate protection for your needs.

- Question: Priya from Bangalore wants to know: “Is health insurance really necessary if I am young and healthy? What are the risk management benefits?”Answer: Yes, even if you are young and healthy, health insurance is a smart way to manage future risks. It ensures financial protection against unexpected medical emergencies, which can be expensive. While you may not need frequent medical care now, accidents or sudden illnesses can happen to anyone. Having a health insurance plan saves you from dipping into your savings or taking on debt to pay for treatments. Plus, health insurance often covers preventive care, which keeps you healthier in the long run.

- Question: Ravi from Pune asks: “How does auto insurance help manage risks when driving in a city like Pune where accidents are common?”Answer: Auto insurance helps manage risks on Pune’s busy roads by covering costs related to accidents, theft, or damage to your vehicle. If you cause an accident, your liability insurance will pay for the other party’s injuries and property damage, while your own car damage can be covered depending on your policy type. This financial protection ensures you are not burdened with high out-of-pocket expenses. Additionally, comprehensive coverage can help if your car is damaged by natural events or vandalism.

- Question: Simran from Delhi is curious: “What is the role of life insurance in risk management, especially for someone with a young family?”Answer: Life insurance plays a crucial role in risk management for families. It ensures your loved ones are financially secure if you unexpectedly pass away. For example, the death benefit from a life insurance policy can cover daily living expenses, pay off mortgages, and fund your children’s education. This safety net is especially important for young families that rely on a primary breadwinner. It provides peace of mind knowing that your family’s future is protected.

- Question: Mohit from Mumbai asks: “What types of risks does home insurance cover, and are natural disasters included in the coverage?”Answer: Home insurance covers a range of risks, including fire, theft, vandalism, and certain types of water damage. In a city like Mumbai, where heavy rains and flooding are common, you should specifically check if your policy includes natural disaster coverage. Some policies cover natural disasters, while others may require additional endorsements. It’s crucial to understand the details of your policy and consider adding disaster insurance if you live in a high-risk area.

- Question: Aarti from Hyderabad wonders: “How do insurance companies determine the premiums I have to pay? Is it based on the level of risk I present?”Answer: Yes, insurance companies determine premiums based on the level of risk you present. They use factors like your age, health, lifestyle, occupation, and the type of coverage you want. For auto insurance, they may consider your driving history, the make and model of your car, and your location. Health insurers look at your medical history, while life insurers consider your age and health status. The riskier you seem, the higher your premium will be.

- Question: Shivani from Jaipur is asking: “What does professional liability insurance cover, and why would a small business owner need it?”Answer: Professional liability insurance, also known as errors and omissions insurance, covers risks related to claims of negligence, mistakes, or failure to deliver promised services. As a small business owner, this insurance is essential if you provide professional advice or services. For instance, if a client claims that your services led to financial loss and sues you, this policy covers legal fees and settlement costs. It’s an important safeguard in a world where lawsuits are common.

- Question: Karan from Chennai inquires: “How does travel insurance help manage risks during international trips? What should I look for in a good policy?”Answer: Travel insurance helps manage risks during international trips by covering unexpected events like trip cancellations, lost luggage, medical emergencies, and flight delays. If you fall ill abroad or your baggage is stolen, travel insurance ensures you don’t face overwhelming costs or disruptions. When choosing a policy, look for coverage that includes medical expenses, emergency evacuation, trip interruptions, and a 24/7 assistance service to handle emergencies.

- Question: Neha from Kolkata asks: “What happens if I miss a premium payment on my insurance policy? Can it lapse, and how does this affect risk management?”Answer: If you miss a premium payment, your insurance policy can indeed lapse, leaving you unprotected. This lapse in coverage can expose you to significant risks, especially if an unforeseen event occurs during the period when you are not covered. Many insurers offer a grace period for payments, but it’s best to avoid missing deadlines. To manage your risk effectively, set reminders for premium due dates or arrange automatic payments to keep your policy active.

- Question: Rahul from Surat wants to know: “Are there any tax benefits associated with insurance policies in India? How can this be part of risk management?”

Answer: Yes, many insurance policies in India come with tax benefits under Section 80C and Section 80D of the Income Tax Act. For instance, life insurance premiums are tax-deductible, and health insurance premiums can provide additional deductions. These benefits help reduce your taxable income, offering financial relief while ensuring you’re protected. By including tax-saving insurance plans in your financial strategy, you manage risk and improve your financial health simultaneously.

Related Blogs:

What is the Difference Between Life Insurance and Health Insurance? How to Choose the Right Policy?

Cyber Insurance: How to Avoid Online Fraud

How to Claim Health Insurance: A to Z Guide

Impact of Regulatory Changes on the Insurance Market

Best Insurance Plans for New Parents: What to Look For

Understanding Cashless Health Insurance Benefits

How to Protect Your Business with Commercial Insurance

What is Directors and Officers Insurance?

Top 10 Insurance Policies Every Family Should Have

What Are the Tax Benefits of Life Insurance Policies?

What is Re-insurance and How Does It Work?

Conclusion

Understanding the role of insurance in risk management is essential for securing your financial future. Insurance provides a safety net that protects you from significant financial losses, whether it’s for your health, vehicle, property, or business. By investing in the right insurance policies, you minimize potential risks and gain peace of mind knowing you are prepared for life’s uncertainties. Remember, as Insurance Baba always says, “Smart risk management begins with the right insurance coverage.” Take the time to assess your risks and choose the insurance plans that best suit your needs.