Retirement is a phase of life that many look forward to—a time to relax, pursue hobbies, and enjoy the fruits of years of hard work. However, reaching those golden years with financial security requires careful planning. Without a solid retirement plan, it can be challenging to maintain the lifestyle you’ve built over the years. From managing savings to choosing the right investment options, retirement planning is all about securing your future so you can live comfortably and worry-free.

With rising costs of living and increasing life expectancy, it’s essential to start planning early. The sooner you begin, the more time you have to grow your savings and build a strong financial foundation for the years ahead. A well-thought-out retirement plan ensures that when the time comes, you’re fully prepared to enjoy your golden years with peace of mind.

1. Why Retirement Planning is Essential for Financial Security

a. The Need for Long-Term Financial Stability

As you approach the later stages of life, maintaining a stable income becomes crucial. Without proper planning, you may face financial difficulties in covering basic needs such as housing, healthcare, and day-to-day expenses. A well-prepared retirement plan acts as a safety net to ensure you can live comfortably.

b. Securing Your Lifestyle in Retirement

Retirement should be a time to relax and enjoy life, not worry about money. By planning ahead, you can secure the lifestyle you’ve grown accustomed to, without drastically changing your spending habits or compromising on your personal goals.

c. Protection Against Inflation

Inflation can significantly impact your savings over time. Proper planning helps ensure your retirement fund grows in a way that keeps pace with the rising cost of living. Without this, your savings could lose value, making it harder to maintain financial stability in the long term.

2. When Should You Start Planning for Retirement?

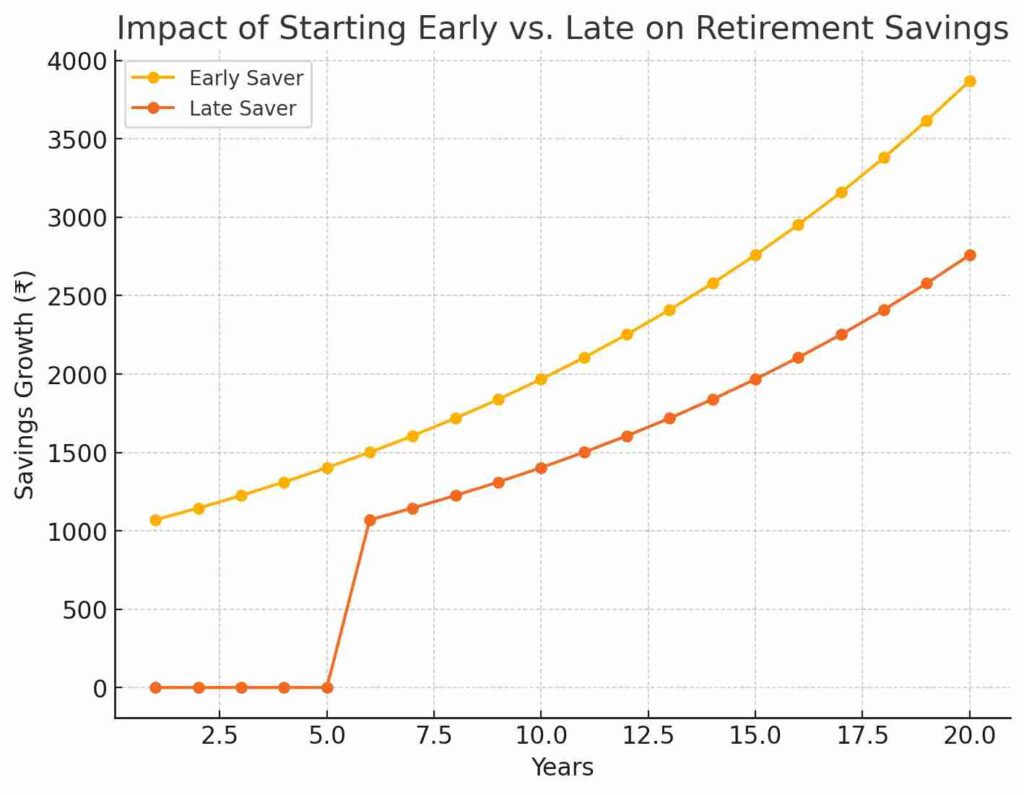

a. The Power of Starting Early

The earlier you start saving for retirement, the more time your investments have to grow. Compounding interest plays a crucial role here, allowing your savings to increase exponentially over time. This makes early planning highly beneficial.

b. Mid-Life Planning: It’s Not Too Late

Even if you’re in your 40s or 50s and haven’t started saving, there’s still time. While you may need to save more aggressively, mid-life retirement planning can still ensure a comfortable future. Making smart investment choices can help bridge the gap.

c. Planning Closer to Retirement

If you’re approaching retirement and haven’t saved enough, there are still strategies to catch up. Downsizing your expenses, maximizing your contributions, or delaying your retirement date are all ways to strengthen your retirement plan.

3. How to Estimate Your Retirement Needs: Key Factors to Consider

a. Calculating Living Expenses

To determine how much you’ll need in retirement, start by estimating your future living expenses. Consider housing, food, utilities, travel, and healthcare. Your financial needs in retirement may differ from your current situation, so planning for them early is essential.

b. Healthcare Costs

One of the most significant expenses in retirement is healthcare. As you age, medical costs can rise, so it’s crucial to include this in your calculations. Look into health insurance or retirement healthcare plans to minimize unexpected expenses.

c. Inflation and Longevity

Factor in inflation and longer life expectancy when calculating your needs. Since people are living longer, your retirement funds may need to last 20-30 years or more. Ensuring your savings grow over time will help safeguard against running out of funds.

4. Building a Retirement Fund: Savings and Investment Strategies

a. Maximizing Retirement Savings Accounts

Investing in retirement accounts, such as public provident fund (PPF) or employee provident fund (EPF), can significantly grow your retirement savings. These accounts often offer tax benefits and long-term returns, making them ideal for retirement planning.

b. Diversifying Investments for Growth

Along with retirement accounts, consider diversifying your investments across stocks, bonds, mutual funds, and real estate. This helps spread the risk and ensures steady growth over time, offering more security as you approach retirement.

c. Automating Your Savings

One of the simplest ways to ensure you consistently save is by automating contributions. Setting up automatic transfers to your retirement accounts removes the temptation to skip savings and helps you stay on track with your goals.

5. Types of Plans For Reteirment : Which One is Right for You?

a. Defined Contribution Plans

These plans, such as 401(k) or NPS (National Pension Scheme), allow you to contribute a fixed amount to your retirement fund, with your employer often matching your contribution. These are tax-deferred accounts, meaning you only pay taxes when withdrawing funds after retirement.

b. Defined Benefit Plans

Also known as pensions, these plans guarantee a specific amount of money based on your salary and years of service. However, these are less common today, with more employers shifting toward contribution-based plans.

c. Individual Retirement Accounts (IRAs)

IRAs are personal retirement accounts that offer tax advantages. There are different types, such as Traditional IRA or Roth IRA, which provide benefits based on your income and financial goals. Choosing the right plan depends on your current financial situation and retirement goals.

6. The Role of Pension Plans in Retirement Planning

a. Guaranteed Income for Life

One of the most significant benefits of a pension plan is the guarantee of regular income throughout your retirement. This ensures you have a steady stream of money to cover your living expenses without worrying about outliving your savings.

b. Employer-Sponsored Pensions

Some employers offer pension plans as part of their benefits package. These pensions are typically based on your salary and years of service. It’s important to understand how these plans work and how they fit into your overall retirement strategy.

c. Government Pension Schemes

In addition to employer-sponsored pensions, government schemes like NPS in India provide another layer of retirement security. These schemes are designed to ensure that individuals have sufficient savings for their post-retirement years.

7. Managing Healthcare Costs in Retirement

a. Planning for Long-Term Care

Healthcare costs can be a major financial burden during retirement, especially if long-term care is needed. It’s crucial to plan for the possibility of long-term care, including nursing home or assisted living costs.

b. Medicare and Health Insurance

Government-provided health insurance schemes, like Medicare in the US or Ayushman Bharat in India, can help offset healthcare costs, but they may not cover all medical expenses. Consider supplemental health insurance to cover any gaps.

c. Setting Up a Healthcare Fund

Setting aside a dedicated healthcare fund ensures you are prepared for unexpected medical expenses. This fund can help cover routine medical costs, prescriptions, and emergencies, ensuring your retirement savings remain intact.

8. Common Retirement Planning Mistakes to Avoid

a. Underestimating Expenses

One of the biggest mistakes people make is underestimating how much they will need to live comfortably in retirement. Inflation, unexpected expenses, and healthcare costs can quickly deplete your savings if you’re not prepared.

b. Not Diversifying Investments

Relying solely on one type of investment can be risky. Diversifying your retirement portfolio reduces risk and ensures your savings grow steadily over time.

c. Delaying Retirement Planning

Starting late can significantly reduce the amount of money available to you in retirement. The earlier you start, the more time your money has to grow, thanks to compound interest.

9. How to Ensure a Steady Income Stream After Retirement

a. Annuities for Consistent Payments

Annuities are a great option to ensure a steady stream of income during retirement. By converting a lump sum of money into regular payments, annuities provide financial security and peace of mind.

b. Withdrawals from Retirement Accounts

Once you retire, you’ll start withdrawing from your retirement accounts like EPF, IRA, or NPS. It’s important to have a strategy in place to ensure these withdrawals last throughout your retirement.

c. Dividends and Rental Income

Another way to generate steady income is by investing in dividend-paying stocks or rental properties. These income streams can supplement your pension or retirement savings and help cover living expenses.

FAQs:

- Amit from Delhi asks:

How much should I save each month for retirement?

The amount you should save each month depends on several factors like your current income, retirement goals, and the age you plan to retire. A good rule of thumb is to aim for saving at least 15-20% of your monthly income. If you start early, even smaller contributions can grow significantly over time due to compounding interest. If you’re starting late, you may need to increase the percentage to make up for lost time. - Priya from Mumbai asks:

What age is considered ideal for retirement?

The ideal age for retirement varies from person to person. While many aim for 60-65 years, some prefer to retire early, say in their 50s, if they have saved enough. It largely depends on your financial situation, health, and personal goals. Early retirement requires more aggressive saving and investment, as your retirement fund needs to last longer. - Ramesh from Bangalore asks:

Can I retire early if I’ve saved enough?

Yes, if you’ve saved enough to cover your living expenses and have a strong retirement plan, you can consider early retirement. However, keep in mind that the earlier you retire, the more years your savings need to last. Ensure your investments are diversified and that you have a strategy in place to cover healthcare costs and inflation over the years. - Neha from Hyderabad asks:

What happens if I outlive my retirement savings?

Outliving your retirement savings is a risk that needs to be planned for. One way to avoid this is by investing in annuities that provide a steady income stream throughout your life. Another option is to ensure you withdraw from your savings in a planned and conservative manner, keeping healthcare and emergency funds separate to avoid depleting your savings too soon. - Rahul from Kolkata asks:

Is it better to invest in real estate or stocks for retirement?

Both real estate and stocks can be valuable components of a retirement plan, but they come with different risks and rewards. Stocks generally provide higher returns over time but can be volatile, while real estate can offer steady rental income and property appreciation. Diversifying your investments across both can help balance risk and ensure steady growth for your retirement fund. - Sunita from Chennai asks:

Are retirement savings taxable?

Yes, in most countries, retirement savings are taxable when you withdraw them, but there are ways to minimize the tax burden. For example, in India, EPF withdrawals after five years of continuous service are tax-free, while in the US, Roth IRA withdrawals are not taxed if certain conditions are met. It’s important to understand the tax implications of your specific retirement account. - Vikram from Lucknow asks:

What if I still have debt when I retire?

Retiring with debt can be challenging, as your income stream may reduce. Before retirement, try to pay off high-interest debt, like credit cards or loans. If you still have debt when you retire, factor in those payments when creating your retirement budget, and avoid taking on new debt unless absolutely necessary. - Kavita from Pune asks:

How can I protect my retirement savings from inflation?

To protect your retirement savings from inflation, consider investing in inflation-linked bonds, real estate, or stocks, which tend to outpace inflation over time. Keeping part of your portfolio in growth-oriented investments can help ensure your savings retain their purchasing power as prices rise. - Rohit from Jaipur asks:

Is healthcare covered in retirement plans?

Healthcare is usually not directly covered in retirement plans unless you have a specific retirement health insurance policy. Many retirees rely on government programs or private health insurance to cover medical costs. Make sure to account for healthcare expenses separately when planning your retirement. - Anjali from Baroda asks:

Should I continue to invest after retirement?

Yes, even after retirement, it’s wise to keep a portion of your savings invested in low-risk, income-generating options. This could include bonds, dividend-paying stocks, or annuities. The idea is to ensure your savings continue to grow to support your expenses, especially if you expect a long retirement.

Related Articles:

Education Insurance: The Foundation of Your Children’s Future

Home Insurance: Ways to Protect Your Dream Home

Agriculture Insurance: A Safety Shield for Farmers

Agriculture Insurance: A Safety Shield for Farmers

Pet Insurance: Protection for Your Beloved Pet

Conclusion:

Retirement is not just the end of your working life; it’s the beginning of a new chapter filled with possibilities. But to fully enjoy these golden years, proper financial planning is crucial. From estimating your expenses to building a solid retirement fund, every step you take now helps secure a future where you can live comfortably without financial worries. Whether you start early or later in life, having a clear and well-thought-out retirement plan gives you the peace of mind to enjoy the years ahead.

At Insurance Baba, we understand the importance of safeguarding your future. Our expert team provides personalized advice and solutions to help you build a robust retirement plan. Whether you’re looking for pension schemes, investment options, or advice on how to manage healthcare costs in retirement, Insurance Baba is here to guide you every step of the way. Start planning today so you can look forward to a future filled with security and freedom.