When it comes to securing an insurance policy, understanding premium calculation is essential. Premiums are the regular payments made to keep your insurance policy active, and they’re calculated based on several factors, such as your age, health, lifestyle, and the coverage you choose. This step-by-step guide will walk you through the entire process of premium calculation, simplifying it into clear, manageable steps. Whether you’re considering life insurance, health insurance, or any other type, knowing how premiums are calculated will help you make informed financial decisions and select the best coverage for your needs.

In this guide, we’ll explore everything from the basics of premium calculation to the individual elements that impact your premium amount. You’ll discover how insurance companies assess risks and how factors like sum assured, tenure, and personal lifestyle play a role. By the end, you’ll have a solid understanding of how to calculate premiums confidently and even find ways to potentially lower your costs.

Got it; let’s delve into each H2 thoroughly with detailed explanations and relevant subheadings, following your instructions for a more comprehensive approach.

1. Understanding the Basics of Premium Calculation

- Defining Insurance Premiums

Premiums are periodic payments made to an insurance company to maintain active coverage. Think of it as a fee to keep your policy up and running, providing financial security in times of need. Whether it’s life, health, or vehicle insurance, calculating premiums is essential for every policyholder as it directly affects the policy’s affordability and long-term viability. - Why Accurate Premium Calculation Matters

Premium calculation helps both insurers and policyholders set realistic expectations. Knowing how premiums are calculated ensures that policyholders understand what they’re paying for, allowing for better financial planning. Misunderstanding this aspect can lead to financial strain, so it’s vital to grasp the basics.

2. Factors That Affect Your Insurance Premium

- Personal Demographics

Age, gender, and location play a crucial role in premium calculation. Typically, younger individuals without pre-existing health issues pay lower premiums than older individuals. Gender also affects premium rates, as different genders statistically present varying risk levels for insurers. Additionally, your location impacts rates, as some areas have higher claims or accident rates. - Type of Insurance Coverage Selected

Coverage options significantly affect premiums. For example, comprehensive policies covering a wide array of risks (like theft, accidents, and third-party liabilities) have higher premiums than more limited plans. Understanding your needs and aligning coverage accordingly can help manage your premium cost while ensuring sufficient coverage.

3. How Age and Health Influence Premiums

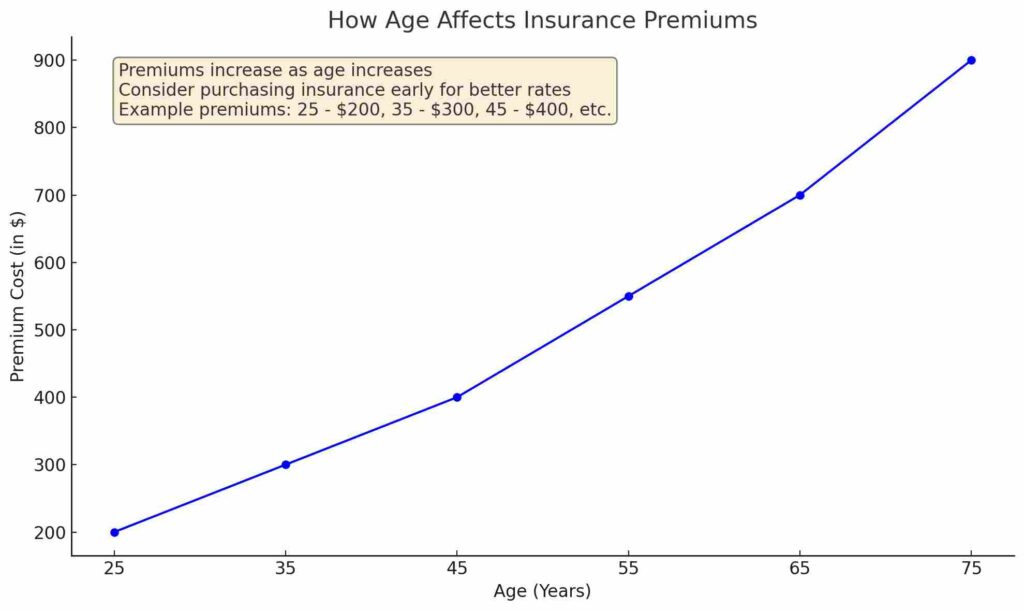

- The Role of Age in Premium Calculation

Age directly correlates with risk, which is why younger individuals tend to have lower premiums. Insurers assume that younger people, particularly those under 35, are healthier and present a lower mortality risk, impacting life and health insurance premiums. - Impact of Health and Medical History

Your health condition plays a major role in determining insurance costs. A history of illnesses or conditions like diabetes can increase premiums, as these conditions pose a higher risk to insurers. Insurance providers often conduct health assessments or require medical records to determine the appropriate premium, especially for life and health insurance policies.

4. Coverage Amount and Tenure: Key Premium Drivers

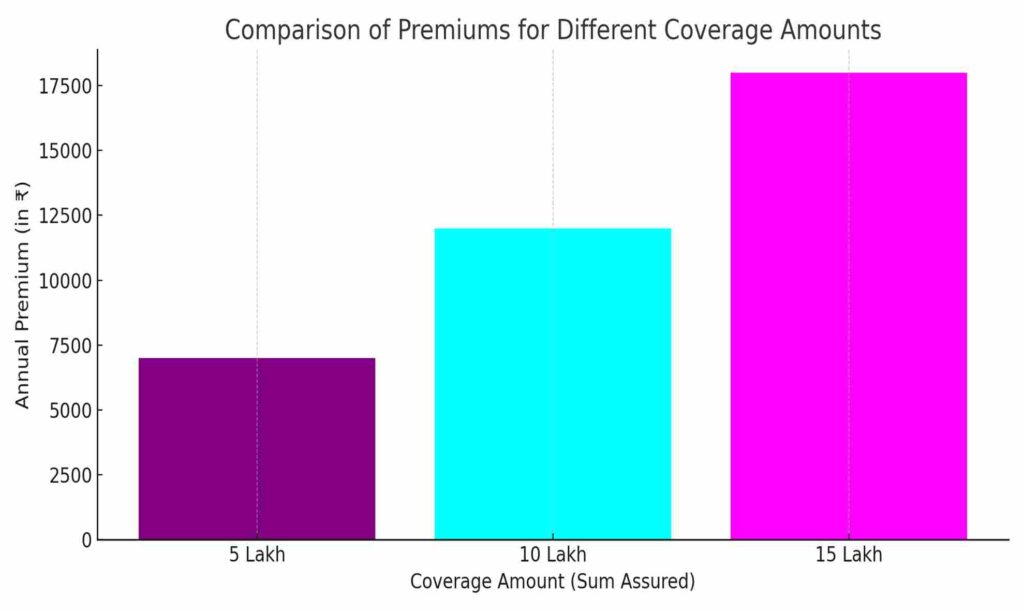

- Sum Assured (Coverage Amount)

The higher the sum assured, the higher the premium. This is because a larger sum assured represents a greater financial commitment for the insurance company. Deciding on the right sum assured is a balance between sufficient coverage and affordable premium costs. - Policy Tenure and Its Effect on Premiums

Policy tenure refers to the length of time you’re covered. Longer tenure policies generally have lower annual premiums because the risk is spread out over many years, giving insurers time to manage potential claims. However, shorter-term policies may come with slightly higher premiums due to the shorter coverage period.

5. The Role of Lifestyle and Habits in Premium Costs

- Lifestyle Choices That Influence Premiums

Habits like smoking, drinking, or living a sedentary lifestyle can increase premium rates significantly, as these habits are linked to higher health risks. Maintaining a healthy lifestyle might even qualify you for lower premium rates. - Risky Occupations and Hobbies

Certain jobs, like construction or mining, involve higher physical risks, increasing the premium. Similarly, if you have high-risk hobbies like skydiving or motor racing, insurers may consider this in your risk profile, leading to higher premiums.

6. Comparing Premium Calculation Across Different Insurance Types

- Life Insurance Premiums

In life insurance, premiums are mainly determined by age, health, and lifestyle factors. For example, younger individuals generally pay less, as they are less likely to claim soon. - Health Insurance Premiums

Health insurance premiums depend on your medical history, age, and lifestyle habits. A person with a pre-existing condition like hypertension may face higher premiums compared to someone in good health. - Vehicle Insurance Premiums

For auto insurance, premiums are influenced by vehicle type, usage, and accident history. High-end or heavily used vehicles attract higher premiums due to the increased likelihood of damage or repairs.

7. Calculating Premiums with Online Tools and Calculators

- Benefits of Using Online Premium Calculators

Online premium calculators are handy tools that provide estimates based on your details, such as age, policy type, and coverage amount. They save time and offer an immediate overview of potential costs, helping you understand your premium without having to meet with an agent. - How to Use a Premium Calculator Effectively

To get the most accurate estimate, enter as much detail as possible into the calculator. Factors like medical history, coverage needs, and lifestyle choices all contribute to a more precise premium estimate.

8. Premium Discounts and Offers: How to Save on Insurance Costs

- Types of Discounts Available

Many insurers offer discounts to encourage safe behavior, such as “no-claim bonuses” or “healthy lifestyle discounts.” These incentives can reduce premiums for policyholders who maintain a good track record or take preventive health measures. - Bundling Insurance Policies

Some insurers offer discounts when you bundle multiple insurance products, like combining health, life, and vehicle insurance. This can lead to significant savings and simplify premium payments.

FAQs

- Anjali from Delhi: “How does my age affect the premium amount for a life insurance policy?”

Age is one of the most critical factors in life insurance premium calculations. Generally, younger individuals are charged lower premiums as they present a lower mortality risk. For instance, if you’re in your 20s or 30s, the premium for a similar policy will often be significantly lower than if you’re in your 50s or 60s. By starting early, you can lock in a lower premium for the long term. - Rohit from Bengaluru: “Can my medical history impact my health insurance premium?”

Yes, your medical history plays a significant role in determining health insurance premiums. If you have pre-existing conditions like hypertension, diabetes, or heart-related issues, insurers may increase your premium as these conditions increase the likelihood of future claims. Sharing accurate medical history is crucial to avoid complications during claim settlement. - Neha from Jaipur: “Do lifestyle habits, like smoking, affect my life insurance premium?”

Absolutely. Lifestyle habits such as smoking, alcohol consumption, or an inactive lifestyle impact premiums for life insurance, as they are associated with higher health risks. Smokers, for example, may pay nearly double the premium of non-smokers. If you’re aiming to reduce your premium, adopting healthier habits can be beneficial. - Vikram from Mumbai: “Does the amount of sum assured influence the premium for my policy?”

Yes, the sum assured, or coverage amount, directly affects your premium. Higher coverage means more risk for the insurer, which results in higher premiums. If you’re looking to balance affordability with coverage, choose a sum assured that meets your family’s needs without overstretching your budget. - Kavita from Hyderabad: “What discounts can I get to lower my car insurance premium?”

Insurers offer several ways to lower car insurance premiums, such as no-claim bonuses (if you don’t file claims), and discounts for installing anti-theft devices. Additionally, insurers may offer lower premiums for safe drivers. Some policies also offer discounts if you bundle your car insurance with other types of insurance, like health or home insurance. - Suresh from Pune: “Can I calculate my insurance premium online before buying a policy?”

Yes, most insurance companies offer online premium calculators on their websites. By entering details like age, health conditions, lifestyle, and desired coverage, you can get an estimated premium. This is especially useful for budgeting and comparing different insurance plans before making a decision. - Meena from Chennai: “Will my occupation impact the premium rate?”

Yes, certain occupations that are considered high-risk, like construction work or firefighting, can lead to higher premiums as these jobs are associated with greater risk. Insurers calculate premiums based on the risk level, so if you work in a high-risk profession, it’s wise to consider policies designed to accommodate these factors. - Rajesh from Kolkata: “Is it better to opt for a long policy tenure to reduce premiums?”

Often, yes. Longer policy tenures spread out the risk over time, allowing insurers to offer lower annual premiums. However, be sure the tenure aligns with your financial goals. For instance, a life insurance policy with a 20-year term may have lower annual premiums than a 10-year term for the same sum assured. - Divya from Ahmedabad: “How do riders affect my life insurance premium?”

Riders, like critical illness or accidental death benefits, add extra protection to your policy but also increase the premium. While these riders provide valuable additional coverage, it’s essential to evaluate whether you need them and if they align with your budget. - Nitin from Lucknow: “Can I reduce my health insurance premium through healthy habits?”

Many health insurers now offer wellness programs that incentivize healthy habits. For instance, regularly exercising, attending health check-ups, and managing chronic conditions can sometimes earn discounts or points that reduce premiums. Engaging in a healthy lifestyle can have a positive impact on your premium over time, in addition to keeping you healthier.

Related Articles:

Career Opportunities & Challenges in the Insurance Sector

How to Understand Investment Risk in Insurance

Business Insurance: Protection for Your Enterprise

Things to Remember When Buying Insurance

Top 10 Insurance Companies in India: A Review

Insurance Policy Claim Denials: Issues and Solutions

Insurance Policy Renewal: Best Practices

The Importance of Insurance Score: How to Improve Your Score

Conclusion

Understanding the premium calculation process is essential to make the most of your insurance policy. Premiums are a regular financial commitment, so knowing what influences them, like age, health, lifestyle, and policy specifics, can empower you to choose coverage that balances your needs and budget. It’s not just about the premium amount—it’s about securing the right protection for yourself and your loved ones in the long term.

For guidance on navigating complex insurance choices, Insurance Baba offers helpful resources and expert advice. With the right knowledge, you can make confident decisions and avoid unnecessary expenses, ensuring you’re always prepared, financially and emotionally. Remember, the best insurance policy isn’t just the one with the lowest premium but one that truly meets your unique needs and provides lasting peace of mind.