As parents, securing your child’s future is one of the most important responsibilities you carry. Education is the key to unlocking that future, but with the cost of quality education rising rapidly, it’s crucial to plan ahead. Whether it’s school fees, college tuition, or even higher studies abroad, the financial burden can be overwhelming without proper preparation.

This is where education insurance becomes invaluable. Not only does it help you systematically save for your child’s educational needs, but it also ensures that in case of any unfortunate circumstances, such as the untimely demise or disability of a parent, your child’s dreams remain protected. With education insurance, you’re securing their opportunities and building the foundation for a bright future.

1. Why It is a Must for Every Parent

a. The Rising Cost of Education

Education has become more expensive with each passing year. Whether it’s school fees, university tuition, or specialized courses, the costs can be staggering. As parents, securing your child’s future requires proper financial planning. Education insurance ensures that you’re prepared for these rising costs, helping you accumulate enough savings over time to cover future expenses.

b. Peace of Mind for Your Child’s Future

With education insurance, parents can rest easy knowing that their child’s future is financially secure. In case of unforeseen circumstances, like the death or disability of the primary earning parent, the policy ensures that the child’s education is uninterrupted, providing the necessary funds even in tough times.

2. How Education Costs are Rising: Planning Ahead is Crucial

a. The Ever-Increasing Tuition Fees

Education, especially higher education, has seen a dramatic rise in tuition fees over the last few decades. What may cost a certain amount today might double in 10-15 years, making it harder for parents to afford without prior planning. With education insurance, you can systematically save and plan for these future expenses without worrying about inflation.

b. Other Costs Beyond Tuition

It’s not just tuition fees that are rising; there are also additional expenses like books, extracurricular activities, travel for studying abroad, and more. These add up quickly, making a financial safety net essential. Education insurance allows parents to plan comprehensively, ensuring all related costs are covered when the time comes.

3. What is Education Insurance and How Does It Work?

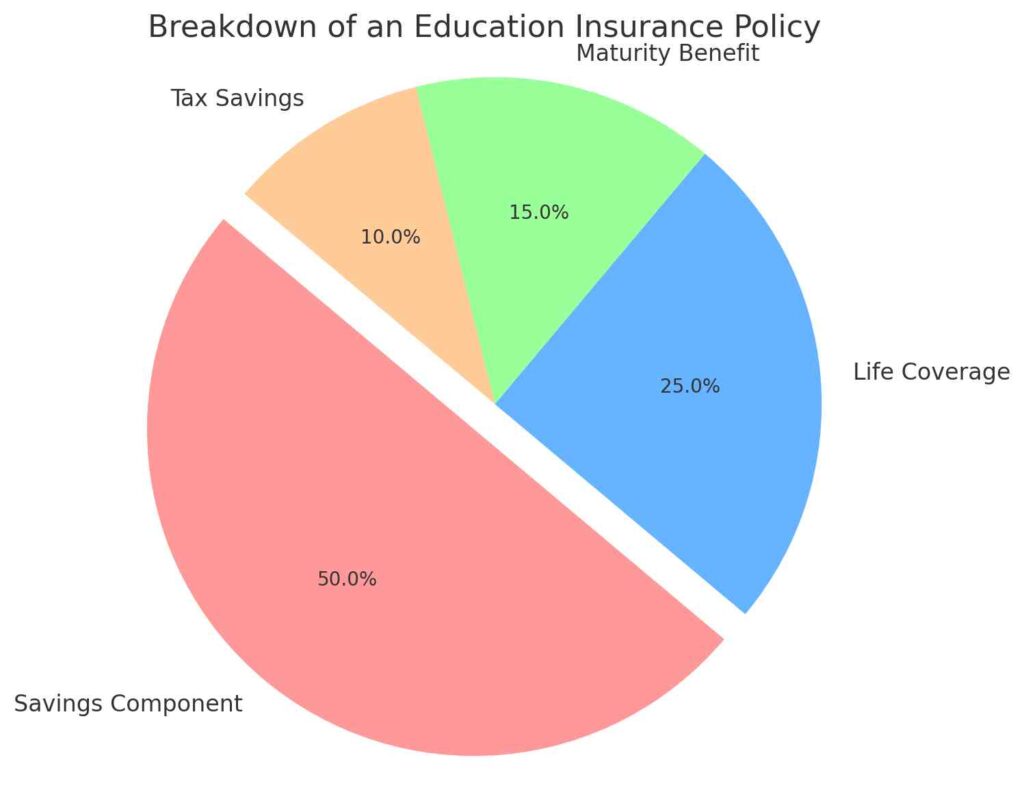

a. A Financial Plan with Insurance Benefits

It is a unique policy that combines savings and insurance coverage. Parents can make regular contributions towards the policy, and these contributions grow over time. In addition to saving, the insurance aspect ensures that the child’s education continues even if the parent is no longer there to support them financially.

b. Maturity and Payout Options

The maturity of the policy coincides with key educational milestones, such as college admission. When the policy matures, the accumulated amount is paid out, providing parents with the necessary funds to cover education costs. Depending on the policy, you can opt for lump sum payouts or periodic payouts, depending on your child’s needs.

4. Benefits of Education Insurance Beyond Just Saving

a. Protection Against Life’s Uncertainties

While savings plans are beneficial, It goes a step further by providing life coverage. If something unfortunate happens to the parent, the insurance policy takes care of the child’s education costs, ensuring that they don’t face financial hurdles during critical years of their academic journey.

b. Tax Benefits for Parents

One of the additional advantages of education insurance is the tax benefits that come with it. Parents can claim tax deductions on the premiums paid under Section 80C of the Income Tax Act, making it a smart financial move for securing your child’s future while also saving on taxes.

5. How to Choose the Right Education Insurance Plan for Your Child

a. Evaluate the Coverage Needed

When selecting an education insurance policy, the first step is to evaluate the coverage amount required. Consider your child’s academic aspirations, potential tuition fees, and related educational expenses. This will give you a clearer idea of how much money you’ll need when the time comes.

b. Look for Flexible Payout Options

Different insurance policies offer varying payout structures. Some may give lump-sum payouts, while others provide staggered payouts aligned with your child’s educational milestones. Choose a policy that offers flexibility based on your child’s expected academic path.

6. Steps to Secure Your Child’s Future with Education Insurance

a. Start Early to Maximize Savings

The earlier you start an education insurance policy, the better. This gives your contributions more time to grow, thanks to the compounding effect. By starting early, you can ensure that the final payout is substantial enough to cover all educational expenses.

b. Review and Adjust as Needed

Regularly review your education insurance policy to ensure it still aligns with your financial goals and your child’s future needs. If your child’s aspirations change or education costs rise faster than expected, you may need to increase your contributions or opt for additional coverage.

7. Common Mistakes to Avoid When Buying Education Insurance

a. Not Starting Early Enough

One of the biggest mistakes parents make is delaying the purchase of It. Starting late reduces the time your savings have to grow, leading to smaller payouts when your child needs it most. Early planning is crucial to ensure your child’s education fund is substantial.

b. Ignoring Inflation’s Impact on Education Costs

Many parents overlook the impact of inflation on education costs. While you might save enough based on today’s fees, inflation will drive these costs higher in the future. Always account for inflation when deciding the coverage amount of your education insurance policy.

8. How Education Insurance Protects Against Unforeseen Events

a. Financial Support in Case of the Parent’s Death

In the unfortunate event of the parent’s death, the education insurance policy steps in to ensure that the child’s education doesn’t suffer. The insurance company continues to provide financial support, ensuring that the child can pursue their education without any interruptions.

b. Ensuring a Bright Future Despite Disability

If the parent becomes disabled and unable to work, the education insurance policy ensures that the child’s educational journey is unaffected. The policy covers education costs, allowing the child to continue their studies without financial burden.

9. Education Insurance vs. Regular Savings Plans: What’s the Difference?

a. Insurance Coverage as an Added Benefit

While regular savings plans help parents save money for their child’s education, they don’t offer protection in case of the parent’s death or disability. Education insurance, on the other hand, provides both savings and life coverage, ensuring that the child’s education fund remains intact even in unforeseen situations.

b. Targeted for Educational Milestones

Unlike regular savings plans, education insurance policies are designed specifically to coincide with your child’s educational milestones. This makes it easier to withdraw funds when they are needed most, such as during college admissions or specialized courses.

10. FAQs:

- Ravi from Delhi asks:

How much should I save for my child’s education?

The amount depends on your child’s educational aspirations and the cost of education in the future. You should also account for inflation when planning. Education insurance helps you save systematically and ensures that the future costs are met. - Priya from Mumbai asks:

What happens if I am unable to pay the premiums?

If you miss premium payments, the policy may lapse. However, many insurers provide a grace period to make up for missed payments. It’s important to discuss this with your insurance provider to understand the specific rules of your policy. - Suresh from Bangalore asks:

Can I use the education insurance fund for other expenses?

While the policy is primarily meant for educational expenses, you can use the funds as needed when the policy matures. However, it’s advisable to stick to the intended purpose to ensure your child’s education remains fully funded. - Kavita from Lucknow asks:

Is education insurance better than a regular savings plan for my child’s future?

Education insurance offers a dual advantage over regular savings plans. While a savings plan simply accumulates funds, education insurance ensures your child’s future is secured even if something unfortunate happens to the earning parent. In the event of death or disability, education insurance provides life coverage, which means the child’s education costs will still be covered, no matter the circumstances. This makes it a much safer and more reliable option for long-term educational planning. - Rohit from Pune asks:

Can I change the payout options later in the policy?

Most education insurance policies offer some flexibility in choosing how the payout is structured. However, once the policy is set, changing payout options mid-way can depend on the terms of your policy and your insurer’s guidelines. Some policies allow for adjustments, like switching from a lump-sum payout to staggered payments that align with your child’s educational milestones, but it’s important to confirm these details before purchasing the policy. - Neha from Chennai asks:

Can I buy education insurance for my child even if they are still very young?

Yes, in fact, the best time to buy education insurance is when your child is very young. The earlier you start, the more time you have to accumulate savings and enjoy the benefits of compounding interest. Additionally, starting early ensures that you are prepared for rising education costs, giving you peace of mind knowing that by the time your child reaches higher education, the funds will be available. - Amit from Delhi asks:

What happens if I need to withdraw funds before the policy matures?

Withdrawing funds before the policy matures depends on the terms of your education insurance plan. Some policies offer partial withdrawal options, while others may have penalties or restrictions. If you anticipate needing early access to the funds, look for a policy with flexible withdrawal options, but keep in mind that withdrawing early might affect the overall savings and maturity amount intended for your child’s education. - Shalini from Hyderabad asks:

Are there any tax benefits with education insurance?

Yes, education insurance policies offer tax benefits under Section 80C of the Income Tax Act, allowing parents to claim deductions on the premiums paid. Additionally, the maturity amount may also be tax-exempt under certain conditions, providing further financial relief. It’s a smart way to secure your child’s future while saving on taxes, making education insurance a valuable investment. - Rajesh from Kolkata asks:

What is the ideal coverage amount I should look for in an education insurance plan?

The ideal coverage amount depends on several factors, including your child’s educational aspirations, the current cost of education, and expected inflation rates. It’s important to evaluate the future cost of tuition, living expenses, and other related educational costs. You should also consider how long you have to save before your child reaches key educational milestones, such as college or higher education. A financial advisor can help you calculate an appropriate coverage amount based on your personal circumstances. - Anita from Jaipur asks:

Can education insurance cover studying abroad?

Yes, most comprehensive education insurance policies can cover the expenses for studying abroad, including tuition fees, travel costs, accommodation, and other related expenses. However, it’s important to check the specifics of your policy to ensure that overseas education is covered. Some policies may offer additional riders for international education, which can further enhance coverage and provide extra financial security for parents planning to send their children abroad for studies.