In today’s digital world, everything from shopping to banking is just a click away. But with this convenience comes an alarming rise in online fraud. Every day, cybercriminals are finding new ways to steal personal data, hack into systems, and cause financial loss. For both individuals and businesses, the threat of cybercrime is real and growing. This is where cyber insurance steps in—a safety net that protects you from the potential financial fallout of online fraud. But how does cyber insurance work, and how can it help you avoid falling victim to online scams? Let’s explore everything you need to know about cyber insurance and the steps you can take to protect yourself online.

1. What is Cyber Insurance?

In today’s rapidly evolving digital landscape, cyber insurance has emerged as a critical tool for mitigating the financial risks associated with online fraud. Cyber insurance is designed to protect individuals and businesses from the financial impact of cyberattacks, data breaches, and other cyber-related incidents. Just like how we insure our homes against damage or our health against illnesses, cyber insurance offers protection against online threats, covering losses that arise from hacking, phishing, identity theft, and even ransomware.

A study by Symantec revealed that one in three internet users has been a victim of some form of cybercrime. With the rise in the number of connected devices and online transactions, the risk of falling prey to cyberattacks has never been higher. Cyber insurance acts as a financial safety net in these situations.

2. Why Do You Need Cyber Insurance in Today’s World?

The internet has changed how we interact, work, and conduct business, but it has also given rise to new forms of criminal activity. With cybercriminals becoming more sophisticated, cyber insurance is no longer an option—it’s a necessity. Businesses, regardless of their size, are particularly vulnerable. A small business can lose thousands or even millions of rupees due to a single successful attack.

Let’s take an example: In 2023, a medium-sized tech company in Bangalore was the victim of a ransomware attack. Their systems were locked, and the hackers demanded ₹25 lakh to release the data. Fortunately, the company had a cyber insurance policy that covered the costs, allowing them to recover without paying the ransom from their own pockets.

Why Does This Matter to You?

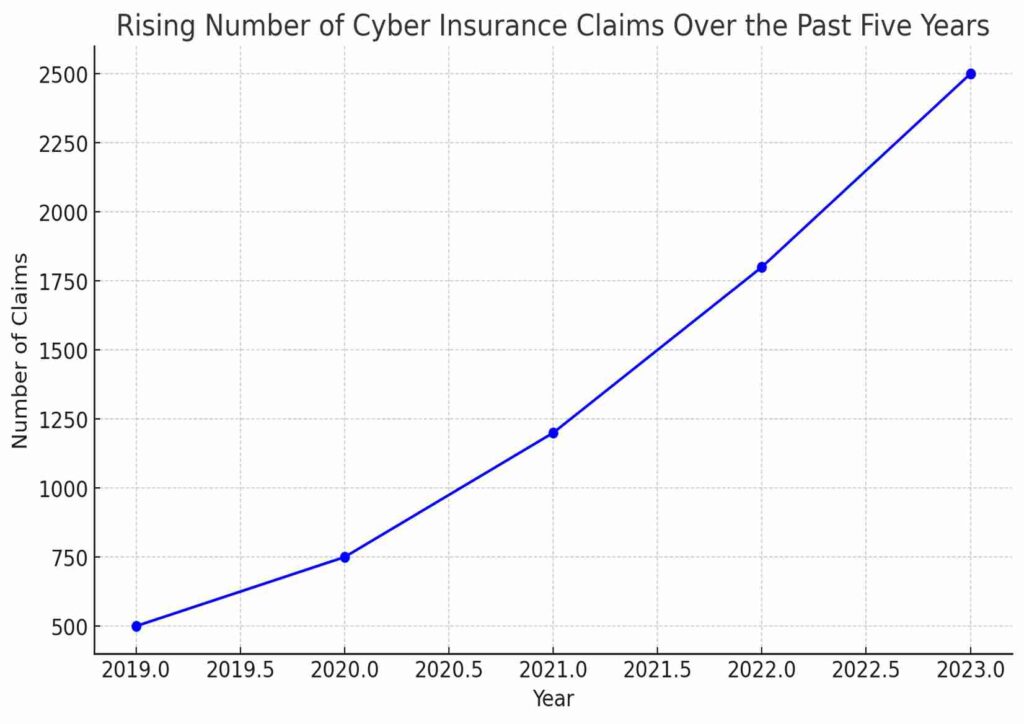

The Indian Computer Emergency Response Team (CERT-In) reports a 22% rise in cyberattacks every year. From phishing emails to identity theft, online fraud is now a daily reality. Cyber insurance protects you from these ever-growing risks, covering not just the financial losses but also the legal and recovery costs.

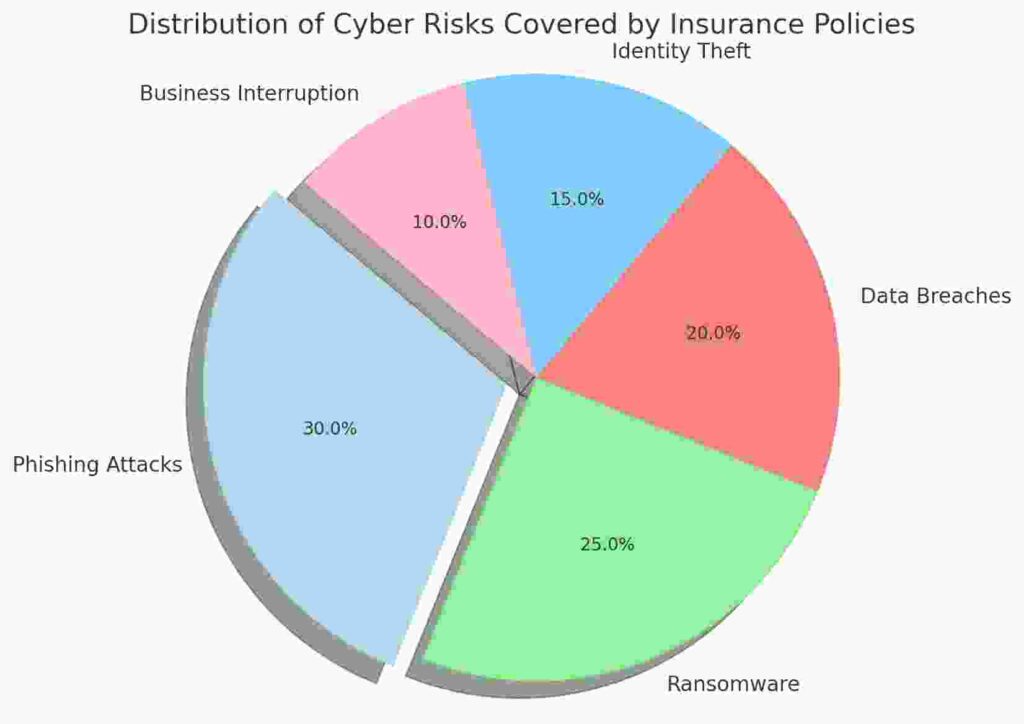

3. Types of Cyber Risks Covered by Cyber Insurance

Cyber insurance policies typically cover a wide range of online threats. Here’s a breakdown of the common cyber risks that are covered:

- Data Breaches: Cyber insurance can cover the costs related to recovering compromised data, legal fees, and notification expenses for data breach victims.

- Phishing Attacks: Phishing scams trick individuals into providing sensitive information like login credentials or bank details. Insurance can help recover the financial loss from such scams.

- Ransomware: If hackers take control of your systems and demand money, cyber insurance can cover the costs of the ransom as well as system recovery.

- Identity Theft: Insurance may cover the financial losses incurred due to identity theft, including the cost of restoring your identity.

- Business Interruption: Cyberattacks often halt business operations. Cyber insurance compensates for the loss of revenue during downtime caused by cyberattacks.

4. How Does It Work?

Understanding how cyber insurance works is essential before purchasing a policy. Cyber insurance policies vary depending on the coverage and the provider, but they generally follow a similar process.

- Incident Occurs: You face a cyberattack, such as a data breach, identity theft, or hacking.

- Notify the Insurer: As soon as the incident happens, you report the event to your insurance provider.

- Claim Processing: The insurer reviews the claim and assesses the damages. This might include an investigation into how the breach occurred and what the potential costs are.

- Compensation: If the claim is valid, the insurer provides financial compensation to cover recovery costs, legal expenses, and any damages incurred.

In many cases, cyber insurance also offers access to a team of cybersecurity experts who help you mitigate the damage, recover lost data, and secure your systems.

5. Who Should Get this type of Insurance?

You might be wondering, “Is cyber insurance really for me?” The answer is yes—if you are online, you are at risk. While large corporations are obvious targets, cybercriminals are increasingly focusing on small businesses and individuals because they tend to have weaker security measures.

For Individuals:

- Anyone who uses online banking, shopping, or even social media is at risk of being hacked.

- Identity theft cases are rising, and having cyber insurance can help cover the costs of restoring your identity and any financial damage done.

For Businesses:

- If you handle sensitive customer data, like credit card information, health records, or personal details, you are a prime target for cyberattacks.

- Small businesses often assume they won’t be targeted, but 60% of small businesses that suffer a cyberattack shut down within 6 months due to financial losses, according to a report by Cisco.

6. How to Choose the Right Insurance Policy

Selecting the right cyber insurance policy can feel overwhelming with the variety of options available. Here’s a simple guide to help you choose the best policy for your needs:

- Assess Your Risks: Are you more likely to face phishing attacks, ransomware, or data breaches? Understanding your specific vulnerabilities will help you pick the right coverage.

- Check the Coverage: Make sure the policy covers all major threats, including data breaches, identity theft, and business interruptions.

- Understand the Exclusions: Like all insurance, cyber insurance comes with exclusions. These might include claims related to pre-existing breaches or negligence in following security protocols.

- Compare Providers: Look for an insurer with a high claim settlement ratio and positive customer feedback.

- Premium vs Coverage: Balance the cost of the premium with the level of coverage offered. A slightly higher premium for comprehensive coverage can save you from huge losses later.

7. Steps to Prevent Online Fraud

While cyber insurance provides financial protection, preventing online fraud is the first step. Here are some essential practices you can follow:

- Use Strong, Unique Passwords: Avoid using the same password across multiple platforms. A password manager can help you create and store strong, unique passwords.

- Enable Two-Factor Authentication: Always enable two-factor authentication (2FA) wherever possible, as it adds an extra layer of security.

- Be Aware of Phishing: Never click on suspicious links or open emails from unknown sources. Always verify the authenticity of emails before responding.

- Update Software Regularly: Ensure that your software, including antivirus and operating systems, is up to date to protect against known vulnerabilities.

- Monitor Your Bank Accounts: Regularly check your bank and credit card statements for any unauthorized transactions.

8. Common Mistakes People Make with Cyber Insurance

Just like any other type of insurance, people often make mistakes when it comes to cyber insurance:

- Underestimating Coverage Needs: Many individuals and businesses think they don’t need comprehensive coverage. But a small oversight in coverage could result in major losses.

- Not Reading the Fine Print: Ignoring policy details and exclusions can lead to denied claims.

- Delaying Cybersecurity Practices: Assuming that cyber insurance alone will protect you is a mistake. You need to implement strong security measures alongside your insurance policy.

- Choosing the Cheapest Policy: Opting for the lowest premium might save you money initially but can result in inadequate coverage.

9-Real-Life Examples of Cyber Fraud and How Insurance Helped

The digital world is filled with opportunities, but it also harbors significant risks. Cyber fraud has become an everyday threat, targeting both individuals and businesses. These attacks can lead to massive financial losses, data breaches, and even reputational damage. This is where cyber insurance steps in, providing the necessary financial and recovery support when things go wrong. Let’s explore some real-life examples of cyber fraud and how cyber insurance saved the day.

1. The Ransomware Attack on a Hospital in Mumbai

In 2022, a well-known hospital in Mumbai faced a crippling ransomware attack. Hackers infiltrated the hospital’s IT system and encrypted sensitive patient data, rendering the system unusable. The hackers demanded a ransom of ₹50 lakh in exchange for decrypting the files. Faced with the dilemma of either paying the ransom or losing critical patient records, the hospital was in a difficult position. However, the hospital had purchased a cyber insurance policy that covered ransomware attacks.

How Cyber Insurance Helped:

The cyber insurance policy covered the cost of IT specialists who were hired to negotiate with the hackers and attempt data recovery without paying the ransom. The insurance also covered the hospital’s revenue losses due to the temporary shutdown of their digital systems. Thanks to the insurance, the hospital was able to recover its data without paying the ransom and avoided significant financial damage. They were back online within a week, with minimal impact on their operations.

2. Phishing Scam Hits a Small E-Commerce Business in Delhi

A small e-commerce startup in Delhi fell victim to a sophisticated phishing scam in early 2023. The company’s finance department received an email that appeared to be from a trusted vendor, asking for an urgent payment. Without verifying the details, the finance manager transferred ₹10 lakh to the hacker’s account, believing it was a legitimate transaction. Once they realized the fraud, the money had already disappeared.

How Cyber Insurance Helped:

The startup had wisely invested in a cyber insurance policy that covered phishing attacks. As soon as the fraud was detected, they contacted their insurer. The insurance policy covered the financial loss incurred in the attack, as well as the cost of a forensic investigation to understand how the phishing scam occurred. Additionally, the policy covered legal fees the company had to pay when customers raised concerns about data safety. This quick response not only saved the startup from financial disaster but also helped them regain customer trust.

FAQs:

- Rahul from Lucknow asks: What exactly does cyber insurance cover?

Answer: Cyber insurance typically covers a wide range of online threats, including data breaches, phishing attacks, ransomware, identity theft, and business interruption. It provides financial support for costs like data recovery, legal fees, and even ransom payments in some cases. It also helps with public relations efforts if your reputation is damaged by a cyberattack. However, coverage can vary depending on the policy, so it’s crucial to understand the specifics before purchasing. - Sneha from Delhi asks: Is cyber insurance necessary for individuals, or is it just for businesses?

Answer: Cyber insurance isn’t just for businesses—individuals can benefit from it too. With the rise of identity theft, phishing scams, and online banking fraud, individuals are increasingly becoming targets for cybercriminals. Cyber insurance for individuals can cover the financial loss from fraudulent transactions, the cost of restoring your identity, and even legal fees if your personal information is misused. Given how much of our lives are now online, cyber insurance is a wise investment for anyone who regularly uses the internet. - Amit from Jaipur asks: Will my cyber insurance cover losses from a phishing attack?

Answer: Yes, most cyber insurance policies cover phishing attacks. Phishing is one of the most common forms of cyber fraud, where hackers trick you into providing sensitive information like your bank details or login credentials. If you fall victim to a phishing scam, your insurance policy can cover the financial losses incurred and help with the recovery process, including forensic investigations to prevent further attacks. - Priya from Mumbai asks: What happens if my business is targeted by a ransomware attack?

Answer: If your business is hit by a ransomware attack, your cyber insurance policy will typically cover the costs of mitigating the damage. This includes hiring cybersecurity experts to negotiate with the hackers, recovering encrypted data, and compensating for lost revenue during downtime. Some policies even cover the ransom payment itself, though experts often recommend not paying it. Additionally, if your business reputation is damaged, the insurance may help with PR efforts to rebuild trust. - Karan from Bangalore asks: How much does cyber insurance typically cost for small businesses?

Answer: The cost of cyber insurance varies depending on factors like the size of your business, the type of data you handle, and the level of coverage you choose. On average, small businesses can expect to pay anywhere from ₹10,000 to ₹50,000 per year for a comprehensive cyber insurance policy. It’s important to balance the cost with the coverage you need—investing in a good policy can save you from massive financial losses in the long run. - Pooja from Kolkata asks: Can cyber insurance help if my personal data is stolen in a data breach?

Answer: Yes, cyber insurance for individuals can cover the financial losses and recovery costs associated with identity theft or data breaches. If your personal information is stolen and used for fraudulent activities, cyber insurance can help restore your identity, recover stolen funds, and cover any legal fees incurred as a result of the breach. It also provides assistance in securing your data to prevent future breaches. - Ramesh from Chennai asks: How do I file a claim if my business suffers a cyberattack?

Answer: Filing a claim after a cyberattack involves a few key steps. First, notify your insurer immediately after the incident occurs. You’ll need to provide detailed information about the attack, including how it happened and the financial losses incurred. Your insurer may also require a forensic investigation to assess the scope of the breach. Once the investigation is complete, the insurance company will process the claim and cover the costs as per the policy terms. Make sure to keep all records of the incident to ensure a smooth claims process.

Conclusion: Protect Yourself from Cyber Fraud with Cyber Insurance

As we continue to live more of our lives online, the risks associated with cyber fraud are growing at an alarming rate. From ransomware attacks and phishing scams to data breaches and identity theft, no one is immune to the dangers of the digital world. Whether you’re an individual or a business, the financial and reputational damage caused by these cybercrimes can be overwhelming.

This is where cyber insurance becomes invaluable. It offers a comprehensive safety net, ensuring that even in the face of a devastating cyberattack, you’re not left to bear the financial burden alone. It doesn’t just cover monetary losses—it also provides resources like forensic investigations, legal support, and reputation management to help you recover from an attack.

At Insurance Baba, we understand that the digital landscape is filled with unpredictable threats. That’s why we offer tailored cyber insurance policies for both individuals and businesses. Whether you’re looking to protect your personal information or safeguard your company’s data, our team of experts will guide you in choosing the right policy for your specific needs. With Insurance Baba, you can navigate the online world with confidence, knowing that you’re fully protected from the risks of cyber fraud.

No matter what type of insurance you need, trust Insurance Baba to provide the expertise, support, and security that you deserve. Let us help you stay one step ahead of the cybercriminals—because in today’s world, peace of mind is priceless.