The insurance sector offers a vast range of Career Opportunities & Challenges in the Insurance Sector , from sales and underwriting to actuarial services and claims management. With the increasing demand for risk management solutions in both personal and corporate spaces, the insurance industry is growing rapidly, creating new jobs and career paths for professionals. However, along with these opportunities come unique challenges—such as navigating complex regulations, dealing with evolving customer expectations, and staying updated with technological advancements.

Whether you’re just starting your career or looking to shift industries, the insurance sector offers the potential for growth and stability. Understanding both the opportunities and challenges will help you carve out a successful career in this dynamic field.

1. Overview of the Career Opportunities & Challenges in the Insurance Sector: A Growing Industry

a. The Rising Demand for Risk Management

The insurance sector has seen tremendous growth over the years, fueled by increasing demand for risk management solutions. Individuals and businesses alike are seeking ways to mitigate financial losses, whether through life, health, property, or commercial insurance policies.

b. Why the Insurance Industry is Expanding Globally

As the global economy expands, the need for comprehensive insurance coverage grows. From emerging markets to developed nations, the insurance industry is expected to continue growing, creating numerous career opportunities for those looking to enter the field.

2. Top Career Opportunities in the Insurance Sector

a. Sales and Insurance Agents

One of the most common career opportunities in the insurance sector is that of an insurance agent. Agents are responsible for selling policies to individuals and businesses. Whether you’re working independently or for an insurance company, the role of an agent offers flexibility and earning potential.

b. Underwriters and Actuaries

Underwriting and actuarial roles are crucial in the insurance industry. Underwriters assess the risks involved in insuring a person or entity, while actuaries use mathematical models to forecast financial risks. Both roles offer excellent career growth prospects due to the specialized skills required.

3. Skills Needed to Succeed in the Insurance Industry

a. Analytical Skills

Professionals in the insurance sector need strong analytical skills to assess risks, calculate premiums, and evaluate claims. Whether you’re in underwriting or claims management, attention to detail and data analysis are crucial to success.

b. Interpersonal and Communication Skills

Working in insurance often involves direct interaction with clients, whether you’re an agent selling policies or a claims adjuster helping customers file claims. Communication skills are key in building trust and helping clients understand complex policies.

c. Problem-Solving Abilities

Given the complex nature of insurance products and the unique challenges each customer faces, being a good problem solver is essential. You need to provide tailored solutions that meet clients’ needs while managing risk effectively.

4. Exploring the Role of an Insurance Agent

a. Key Responsibilities of Insurance Agents

The primary responsibility of an insurance agent is to help clients choose the right policies based on their needs and risk profiles. This involves explaining policy details, assisting with paperwork, and offering guidance on claims procedures.

b. Career Opportunities & Challenges for Insurance Agents

One of the biggest opportunities for insurance agents is the potential for high earnings through commissions. However, the role also comes with challenges, such as meeting sales targets, handling rejections, and keeping up with constantly changing policies and regulations.

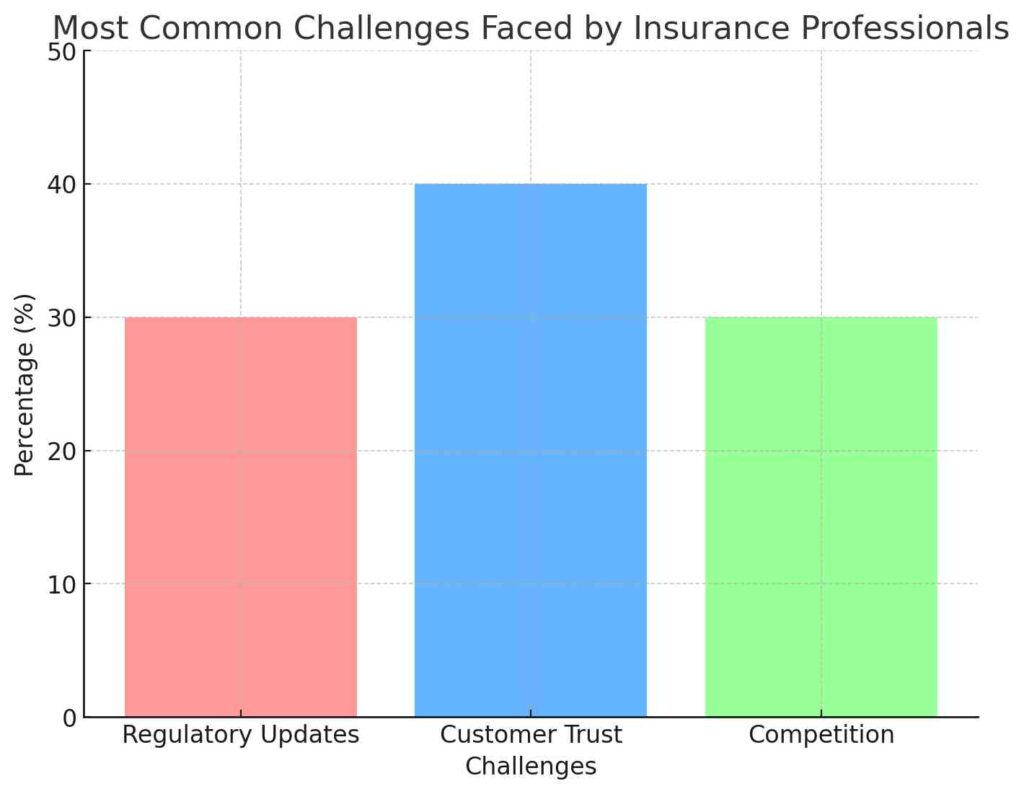

5. Challenges Faced by Insurance Professionals

a. Adapting to Regulatory Changes

Insurance is a highly regulated industry, and professionals must stay updated with evolving regulations, both at the local and global levels. This can be challenging, as failing to comply with regulations can result in fines or legal action.

b. Customer Trust and Market Competition

Building customer trust is a significant challenge for insurance professionals, especially in a competitive market where clients are bombarded with numerous options. Maintaining client relationships and providing transparent services are critical to long-term success.

6. The Impact of Technology on Insurance Careers

a. Insurtech and Digital Transformation

The rise of Insurtech—the use of technology to simplify and improve the insurance industry—has changed how insurance professionals work. From automated claims processing to AI-driven risk assessments, technology is reshaping roles across the sector.

b. Skills Needed in a Tech-Driven Insurance Industry

As technology becomes more integrated, insurance professionals need to adapt by learning new skills, such as data analytics, cybersecurity, and digital customer service. These skills open up more career opportunities in tech-driven roles within the insurance industry.

7. Career Growth and Advancement in the Insurance Industry

a. Opportunities for Career Progression

The insurance industry offers significant opportunities for career advancement. Starting as an agent or underwriter, you can move into managerial roles, leading teams or entire departments. Additionally, specialized certifications and advanced degrees can accelerate your growth.

b. Challenges in Career Growth

While there are numerous growth opportunities, one of the challenges professionals face is keeping up with the changing demands of the industry. Constantly upgrading skills and staying updated with industry trends are necessary to maintain a competitive edge.

8. How to Break into the Insurance Sector: A Guide for Freshers

a. Educational Requirements and Certifications

While many entry-level roles in the insurance sector don’t require specialized degrees, having a background in finance, business, or risk management can give you an edge. Additionally, pursuing certifications like CII (Chartered Insurance Institute) can help boost your profile.

b. Internships and Networking

For freshers, gaining practical experience through internships or apprenticeships is a great way to break into the industry. Networking with professionals and attending insurance seminars or events can also help you learn more about career opportunities.

9. Addressing the Work-Life Balance in the Insurance Profession

a. Flexible Working Hours for Agents

One of the advantages of being an insurance agent is the flexibility it offers. Many agents work on their own schedules, which can provide a better work-life balance compared to traditional office jobs. However, this also means that income can fluctuate based on sales.

b. Work Pressure in Corporate Insurance Roles

For those working in corporate insurance or underwriting, the workload can be intense, especially during peak times or when dealing with complex claims. Managing this workload while maintaining a work-life balance is one of the key challenges in the insurance profession.

FAQs: Your Questions About Career Opportunities & Challenges in the Insurance Sector

- Rohit from Delhi asks:

What qualifications do I need to start a career in insurance?

The insurance sector offers various entry points depending on your career goals. For roles like insurance agents, formal degrees are not always required, though a background in business or finance can be helpful. For more technical roles, such as underwriting or actuarial services, a degree in mathematics, finance, or risk management is often needed. Certifications like CII (Chartered Insurance Institute) or IRDAI (Insurance Regulatory and Development Authority of India) licensing are valuable for career progression. - Priya from Mumbai asks:

What challenges should I expect when working as an insurance agent?

Working as an insurance agent comes with several challenges. One major hurdle is meeting sales targets, as income is often commission-based. Agents must also deal with market competition and customer rejections, which can make the role stressful at times. Additionally, keeping up with changing insurance policies and regulations can add complexity to the job. However, the potential for high earnings and flexibility in work hours often makes it a rewarding career. - Anand from Bangalore asks:

How can I advance my career in the insurance sector?

Advancing in the insurance sector requires continuous learning and skill development. Pursuing professional certifications such as CII or Fellow of the Institute of Actuaries (FIA) can fast-track your career growth. Networking within the industry and gaining experience in different roles—such as claims, underwriting, and risk management—also opens doors to leadership positions. Staying updated on the latest industry trends and technology developments, especially in Insurtech, is key to moving forward. - Sunita from Hyderabad asks:

Are there work-from-home opportunities in the insurance industry?

Yes, many insurance companies now offer work-from-home opportunities, especially for roles like insurance agents, customer service, and claims processing. The adoption of digital platforms and Insurtech has made it easier for professionals to work remotely. However, some roles, such as underwriting and risk management, may still require office-based work for better coordination and decision-making. - Raj from Jaipur asks:

How does technology affect career opportunities in the insurance sector?

Technology is reshaping the insurance sector in many ways, especially with the rise of Insurtech. This has led to the creation of new roles focused on data analytics, cybersecurity, and digital claims management. Professionals who are skilled in these areas, as well as those who can adapt to using new technologies in traditional roles, are highly valued. The industry is also seeing a growing demand for specialists who can work on AI-based tools and platforms for policy underwriting and customer service. - Kavita from Pune asks:

What is the earning potential in the insurance sector?

The earning potential in the insurance sector varies depending on the role. Insurance agents, for instance, often earn based on commission, which means income can fluctuate but also provides high earning potential, especially in the life and health insurance segments. Corporate roles like underwriters, actuaries, or claims managers usually offer stable salaries with room for growth, especially with experience and certifications. Additionally, leadership roles in insurance firms can come with significant compensation packages, bonuses, and incentives. - Vikram from Lucknow asks:

What are the biggest challenges facing the insurance industry today?

One of the biggest challenges facing the insurance industry is keeping up with regulatory changes, which can vary by region and sector. Professionals must be aware of new rules and laws that impact how policies are written and sold. Another challenge is the growing competition in the market, with many insurance providers vying for the same customer base. Lastly, the rapid advancement of technology requires constant learning and adaptation, especially as automation and AI transform traditional roles. - Rohit from Kolkata asks:

Is it difficult to switch career paths within the insurance industry?

Switching career paths within the insurance industry is not difficult if you are willing to learn new skills. For example, an insurance agent can transition into underwriting or claims management by pursuing relevant certifications and gaining experience. Similarly, someone in a back-end role, like policy processing, can move into sales with the right training. The key to a successful switch is understanding the new role’s requirements and actively pursuing professional development. - Neha from Chennai asks:

How can I ensure a good work-life balance in the insurance sector?

Maintaining a work-life balance in the insurance industry depends on the role you choose. Insurance agents often have flexible work schedules, which can allow for a better work-life balance. However, in corporate roles like underwriting or claims management, the workload can be heavier, especially during peak times. To manage this, setting clear boundaries, prioritizing tasks, and adopting efficient work habits are essential. Many companies also offer flexible working hours and remote work options to support better balance. - Ritika from Baroda asks:

What is the future outlook for careers in the insurance sector?

The future of careers in the insurance sector looks promising, especially with the rise of digital transformation and Insurtech. Roles in data analysis, AI, and cybersecurity are expected to grow, while traditional roles like sales, underwriting, and claims management will continue to be in demand. The industry’s resilience to economic downturns and the increasing need for risk management services make it a stable and growth-oriented career choice for years to come.

Related Articles:

Agriculture Insurance: A Safety Shield for Farmers

Agriculture Insurance: A Safety Shield for Farmers

Pet Insurance: Protection for Your Beloved Pet

How to Understand Investment Risk in Insurance

How to Understand Investment Risk in Insurance

Conclusion: Unlocking Your Career Opportunities & Challenges in the Insurance Sector

The insurance sector offers a wealth of opportunities for professionals looking to build stable and rewarding careers. Whether you’re interested in sales, underwriting, actuarial roles, or even Insurtech, the industry provides room for growth and specialization. However, like any career path, it comes with its own set of challenges—from staying updated with regulatory changes to adapting to new technologies.

At Insurance Baba, we understand the evolving landscape of the insurance industry. Whether you’re just starting your career or looking to advance, our experts provide insights and guidance on how to navigate these opportunities and challenges effectively. Explore the endless possibilities that the insurance sector offers, and let Insurance Baba be your partner in success.