Running a business involves navigating numerous risks, from property damage to lawsuits, and even unforeseen disasters. As a business owner, it’s crucial to protect your enterprise from these potential threats with the right Commercial insurance. Whether you run a small start-up or a large corporation, having adequate insurance ensures that when unexpected events occur, your business is financially protected and able to recover quickly.

Business insurance covers a variety of aspects such as liability, employee health, property damage, and even cyber risks. By securing the appropriate coverage, you can safeguard your investments, employees, and assets, ensuring that your business continues to thrive, no matter what challenges arise.

1. What is Business Insurance and Why Does Your Enterprise Need It?

a. Understanding Business Insurance (or Commercial Insurance)

At its core, business insurance, also known as commercial insurance or enterprise insurance, is a policy that protects companies from various financial risks. It covers losses related to property damage, liability claims, employee injuries, and more.

b. Importance of Risk Management

Running a business comes with several risks. Commercial risk protection helps mitigate financial losses, allowing the company to continue operations smoothly even when unexpected events occur.

c. Safeguarding Against Legal Liabilities

Corporate risk insurance protects businesses from legal claims related to injuries, accidents, or negligence. This is essential for all businesses, regardless of their size or industry.

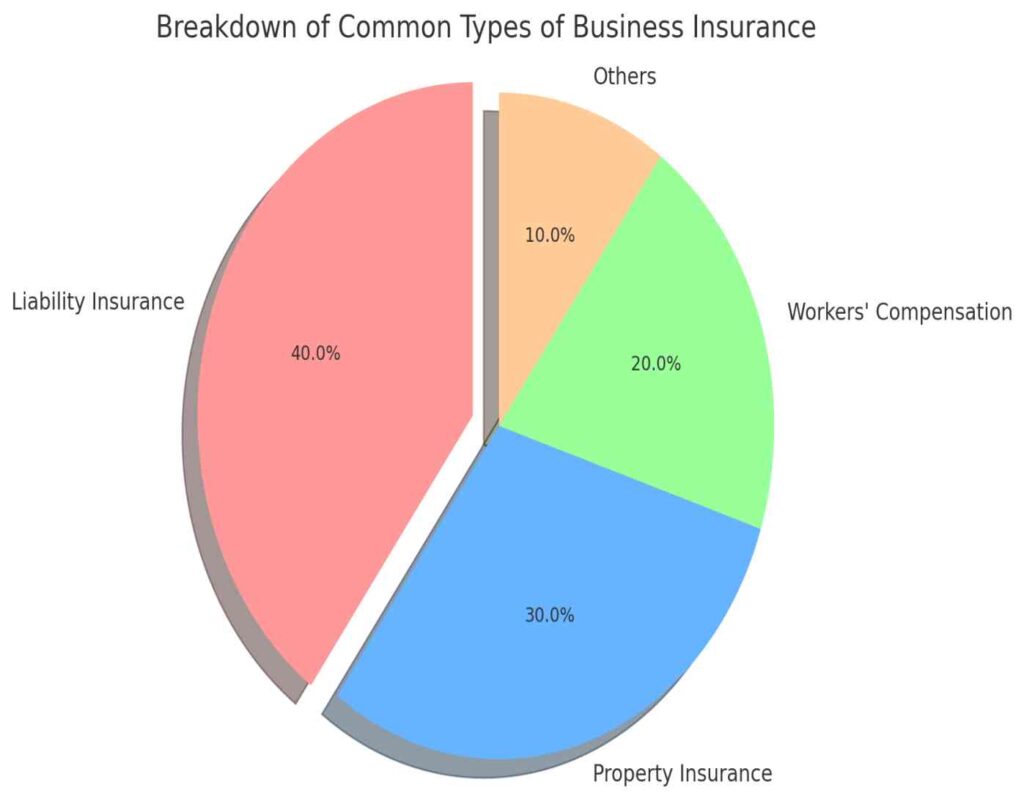

2. Types of Business Insurance: Finding the Right Coverage

a. Liability Insurance for Companies

Commercial liability insurance protects businesses from lawsuits due to bodily injury or property damage caused to others. It’s crucial for businesses to avoid massive financial losses due to legal disputes.

b. Property Insurance

Company insurance that covers property includes damage to buildings, inventory, and equipment. This ensures that physical assets are protected from theft, fire, or natural disasters.

c. Workers’ Compensation Insurance

This type of enterprise insurance protects both the business and its employees. It covers medical costs and lost wages if an employee is injured on the job, providing security for the workforce.

3. How Business Liability Insurance Protects Your Company

a. Protection Against Lawsuits

Commercial liability insurance safeguards companies from legal claims made by third parties. This could include slip-and-fall accidents or damage caused by faulty products.

b. Covering Legal Fees and Settlements

Legal fees can be exorbitant. Having corporate risk insurance ensures that legal defense costs and any settlement fees are covered, preventing out-of-pocket expenses.

c. Peace of Mind for Business Owners

With business risk coverage, owners can focus on growing their enterprise without constantly worrying about potential lawsuits that could financially cripple their company.

4. Property Insurance: Safeguarding Your Business Assets

a. Protecting Physical Assets

Commercial coverage includes the protection of buildings, machinery, inventory, and more. Whether it’s theft or fire damage, property insurance ensures that your assets are covered.

b. Rebuilding After Natural Disasters

If a business’s property is damaged due to a natural disaster like a flood or earthquake, business risk coverage helps cover the repair or rebuilding costs, ensuring minimal downtime.

c. Security for Inventory and Equipment

For businesses dealing with physical goods, losing inventory can be a significant blow. Enterprise insurance covers loss or damage to inventory and essential equipment, safeguarding operational continuity.

5. Employee Insurance: Ensuring Workforce Protection

a. Health and Medical Coverage for Employees

Corporate insurance often includes employee health plans, which cover medical expenses for workers. This not only protects employees but also boosts morale, showing that the company values its workforce.

b. Workers’ Compensation Plans

Commercial risk protection for employees covers work-related injuries or illnesses. These plans ensure that injured employees receive compensation while the business is protected from lawsuits.

c. Employee Life Insurance

Many companies offer business coverage for life insurance as part of their employee benefits package, ensuring financial security for employees’ families in the case of unforeseen events.

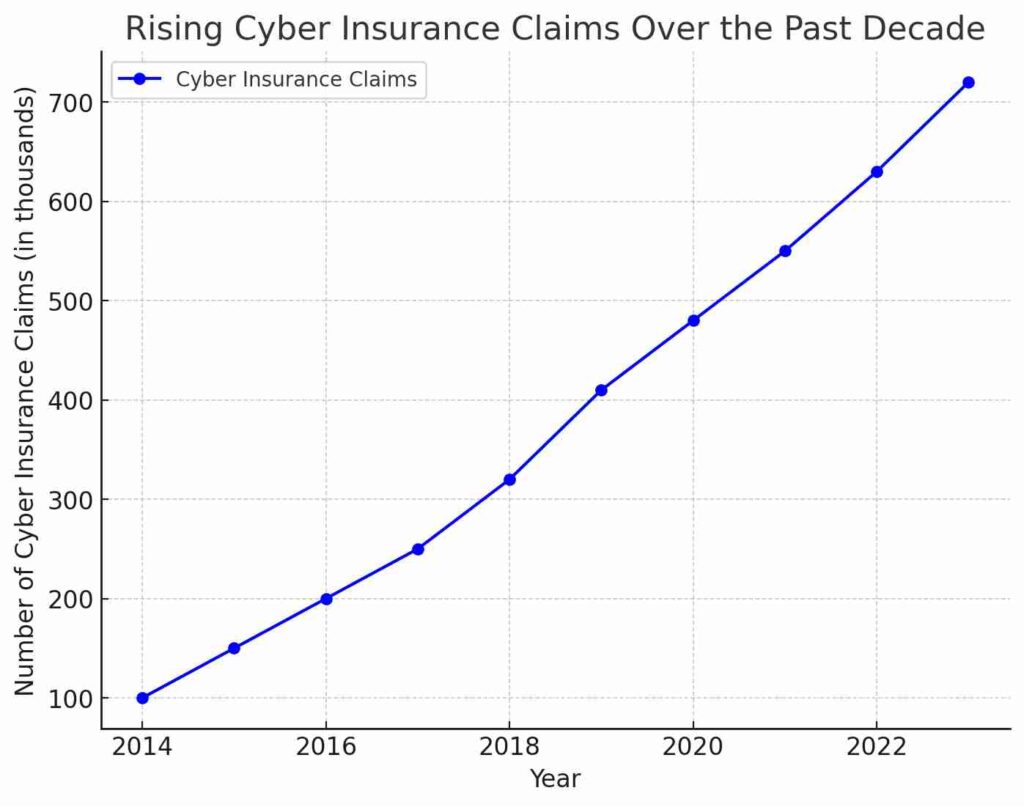

6. Cyber Insurance: Protecting Your Business from Digital Threats

a. The Growing Importance of Cybersecurity

As businesses move online, they become targets for cyberattacks. Cyber insurance is an essential component of commercial risk protection, covering data breaches, ransomware attacks, and other online threats.

b. Recovering from Data Breaches

A data breach can be financially devastating. Corporate risk insurance helps cover the costs of notifying affected customers, recovering lost data, and handling legal liabilities related to the breach.

c. Liability Protection for Cyber Attacks

Beyond data recovery, commercial liability insurance also covers any claims made by third parties due to the mishandling of their personal data during a cyberattack.

7. How to Choose the Best Business Insurance Plan

a. Assessing Business Needs

To choose the best business coverage, you must first assess the specific risks your company faces, whether it’s related to property, liability, or cyber threats.

b. Comparing Insurance Providers

Not all insurance providers offer the same level of corporate insurance. Comparing multiple quotes ensures you get the best balance between coverage and affordability.

c. Customizing Your Insurance Plan

Every business is unique. Tailoring a commercial insurance plan to include the necessary protections, like property or cyber insurance, ensures comprehensive coverage without overspending.

8. Common Business Insurance Mistakes to Avoid

a. Underinsuring Your Business

One common mistake is not purchasing enough enterprise insurance. Many businesses underestimate their needs, leaving them vulnerable in case of large-scale disasters.

b. Not Updating Coverage Regularly

As businesses grow, so do their risks. Failing to update commercial coverage can leave new assets or operations unprotected.

c. Ignoring Cybersecurity Risks

In today’s digital age, ignoring cyber threats is a huge mistake. Including cyber insurance as part of your corporate risk protection plan is crucial for modern businesses.

9. Benefits of Having Comprehensive Business Insurance Coverage

a. Protection from Financial Losses

Having comprehensive business insurance means you’re financially protected from accidents, property damage, and lawsuits that could otherwise cripple your company.

b. Peace of Mind for Business Owners

Knowing that your commercial risk protection plan covers a wide range of potential issues allows you to focus on growing your business, rather than constantly worrying about risks.

c. Enhanced Employee Satisfaction

Offering employee benefits like health coverage or life insurance as part of your business coverage not only protects your staff but also improves morale and productivity.

FAQs: Your Questions About Business Insurance Answered

- Rohit from Delhi asks:

What exactly does business insurance cover?

Business insurance (also known as commercial insurance or enterprise insurance) covers a wide range of risks that businesses face. This includes property insurance to protect physical assets like buildings, equipment, and inventory, liability insurance to cover legal claims related to injuries or accidents, and cyber insurance to guard against digital threats. The specific coverage depends on the policy you choose, so it’s essential to understand what your plan includes. - Priya from Mumbai asks:

Do I need business insurance if my company is small?

Yes, even small businesses need business risk coverage. Whether it’s protection against property damage, employee injuries, or customer lawsuits, small companies face many of the same risks as larger ones. Additionally, commercial liability insurance can help cover legal fees if your business is sued, which can be financially devastating for smaller enterprises. - Anand from Bangalore asks:

What is the difference between property insurance and liability insurance?

Property insurance covers physical assets like buildings, machinery, and inventory, protecting your business from damage due to fire, theft, or natural disasters. On the other hand, commercial liability insurance protects your business from legal claims. This can include lawsuits from customers who get injured on your premises or claims of negligence. Both types of insurance are crucial to fully protect your business. - Neha from Hyderabad asks:

Is cyber insurance necessary for my business?

In today’s digital age, cyber insurance is becoming increasingly essential. Cyberattacks, data breaches, and ransomware can cost businesses millions in damages. Cyber risk protection helps cover the financial losses from such attacks, as well as legal fees, customer notification, and recovery costs. Even if you run a small business, if you handle sensitive customer data or rely on digital systems, cyber insurance is worth considering. - Ramesh from Pune asks:

How can I lower my business insurance premiums?

There are several ways to lower your business insurance premiums. First, regularly reviewing and adjusting your coverage ensures you’re not paying for more than you need. Bundling different policies, like commercial liability insurance and property insurance, with the same provider can also reduce costs. Additionally, maintaining a safe workplace and implementing strong cybersecurity measures can help lower premiums. - Sunita from Chennai asks:

What happens if an employee gets injured on the job?

If an employee is injured on the job, workers’ compensation insurance (a type of business coverage) helps cover medical expenses and lost wages. This not only ensures your employee receives proper care, but also protects your business from potential lawsuits. In many places, it’s legally required for businesses to have workers’ compensation insurance. - Vikram from Lucknow asks:

Can I customize my business insurance policy?

Yes, many insurance providers offer customizable commercial insurance plans. You can tailor your policy based on the specific risks your business faces. For instance, if you operate in a high-risk industry like construction, you may need higher coverage for accidents, while a tech company may prioritize cyber insurance. Customizing your policy ensures you’re only paying for the protection you need. - Rohit from Jaipur asks:

What should I do if my business insurance claim is denied?

If your business insurance claim is denied, the first step is to review the denial letter to understand the reason. Often, claims are denied due to missing information or because the event wasn’t covered under your policy. If you believe the denial was unfair, gather supporting documentation and contact your insurance provider to appeal the decision. A corporate risk insurance provider may also have a dispute resolution process. - Kavita from Kolkata asks:

Is business insurance tax-deductible?

Yes, in many cases, business insurance premiums are tax-deductible. This includes coverage like commercial risk protection, liability insurance, and property insurance. These deductions can help reduce your taxable income and overall tax burden. Always consult a tax professional to understand what deductions you qualify for. - Ritika from Baroda asks:

How often should I review my business insurance policy?

It’s a good idea to review your business insurance policy annually or whenever your business undergoes significant changes, like expanding operations or acquiring new assets. Regular reviews ensure that your policy continues to provide adequate coverage and that you’re not overpaying for unnecessary protection. Updating your commercial coverage can also help address new risks as your business grows.

Related Articles:

Education Insurance: The Foundation of Your Children’s Future

Home Insurance: Ways to Protect Your Dream Home

Agriculture Insurance: A Safety Shield for Farmers

Agriculture Insurance: A Safety Shield for Farmers

Retirement Planning: Preparing for the Golden Years

Vehicle Insurance: How to Protect Your Dream Car?

Home Insurance: Ways to Protect Your Dream Home

Conclusion: Secure Your Business’s Future with the Right Insurance Coverage

In today’s unpredictable world, having the right business insurance is not just a necessity—it’s a lifeline for your company. Whether it’s protecting your assets, safeguarding against legal claims, or ensuring employee well-being, the right insurance plan shields your enterprise from financial losses and helps you focus on growth. From small businesses to large corporations, every company needs to evaluate its risks and invest in a comprehensive insurance strategy that aligns with its unique needs.

At Insurance Baba, we understand the challenges businesses face in choosing the right coverage. Our team provides tailored solutions to meet your specific requirements, whether you’re looking for commercial risk protection, cyber insurance, or liability insurance. With Insurance Baba by your side, you can run your business confidently, knowing you’re covered for every eventuality.