Agriculture is the backbone of our country, and for many farmers, their livelihood depends on the unpredictable forces of nature. Droughts, floods, pests, and disease can wipe out an entire season’s worth of hard work, leaving farmers in financial distress. This is where agriculture insurance steps in, offering farmers the safety net they need to recover from unexpected losses.

In this guide, we’ll explore how agriculture insurance works, what it covers, and why it’s an essential protection for farmers across India. With the right insurance policy in place, farmers can focus on their crops and fields, knowing that they’re shielded from the uncertainties of weather and market fluctuations.

1. Why Agriculture Insurance is Essential for Farmers

Farming is one of the most unpredictable professions, heavily dependent on natural factors like rainfall, temperature, and soil conditions. However, nature isn’t always kind, and when disasters like droughts, floods, or pest infestations hit, they can destroy a farmer’s entire crop yield. This not only affects the farmer’s income but can also lead to debt and financial ruin. Agriculture insurance acts as a safety net for farmers, providing them with financial support during times of crisis. By compensating for crop losses, it helps farmers recover quickly and continue their work without falling into severe debt.

2. Types of Agriculture Insurance Available in India

India offers a variety of agriculture insurance schemes, each designed to address the unique challenges farmers face. Some of the most popular types include:

- Crop Insurance: Covers losses due to weather conditions like drought, flood, or excessive rain.

- Livestock Insurance: Protects farmers from losses related to the death or illness of livestock.

- Farm Equipment Insurance: Covers damages or loss of essential farm machinery like tractors and harvesters.

Each type of insurance is tailored to specific risks that farmers encounter, allowing them to choose the policy that best fits their needs.

3. How Does Agriculture Insurance Work?

Agriculture insurance works by compensating farmers for their financial losses due to unforeseen events. The process usually starts with the farmer selecting an insurance plan that covers specific risks like weather-related events, pests, or diseases. Premiums are paid annually, and if a covered event occurs, the farmer can file a claim. The insurance company will then assess the damage and, once verified, pay out the compensation based on the agreed terms. This compensation helps farmers recover the cost of seeds, labor, and other inputs, ensuring they don’t suffer long-term financial damage.

4. What Risks Are Covered Under Agriculture Insurance?

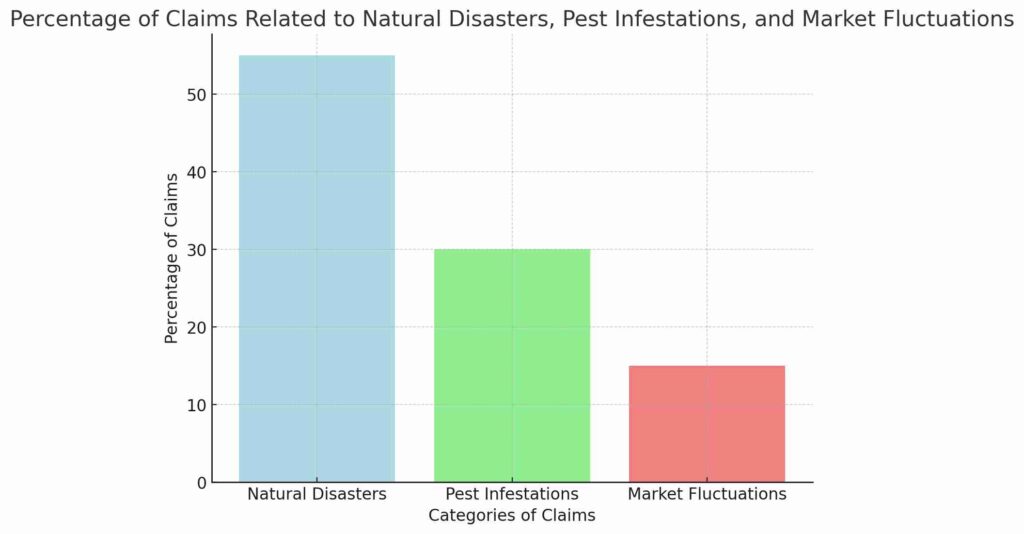

Agriculture insurance covers a wide range of risks, providing protection for both crop production and livestock. Common risks include:

- Natural Disasters: Events like drought, floods, hailstorms, and cyclones that damage crops or livestock.

- Pests and Diseases: Infestations or diseases that affect the health of crops or animals.

- Market Fluctuations: Some policies cover price drops in the market, protecting farmers from financial losses when selling their produce.

5. Step-by-Step Guide to Filing an Agriculture Insurance Claim

Filing an agriculture insurance claim is a straightforward process, but it’s essential to follow each step carefully to avoid delays or rejections. Here’s how farmers can file a claim:

- Inform the Insurer: Notify the insurance company as soon as the damage occurs.

- Provide Documentation: Submit relevant documents like proof of crop damage, weather reports, and land ownership records.

- Inspection: The insurance company will send an official to inspect the damage.

- Claim Settlement: Once the inspection is complete, and the damage is verified, the insurer will process the claim and provide compensation to the farmer.

By following these steps, farmers can ensure that their claims are processed quickly and efficiently.

6. Top Mistakes Farmers Should Avoid When Buying Agriculture Insurance

Farmers often make mistakes when purchasing agriculture insurance, which can lead to claim rejections or inadequate coverage. Here are some common mistakes to avoid:

- Not Understanding Policy Coverage: It’s crucial for farmers to know exactly what their policy covers. Many assume they are protected against all risks, only to find out later that certain damages aren’t included.

- Ignoring Policy Exclusions: Every insurance policy comes with exclusions. Failing to understand these can lead to claim denials.

- Not Insuring at the Right Time: Some farmers wait too long to buy insurance, leaving their crops or livestock vulnerable during high-risk periods.

Avoiding these mistakes ensures that farmers get the full benefits of their insurance coverage.

7. How to Choose the Right Agriculture Insurance Policy for Your Crops

Choosing the right agriculture insurance policy depends on several factors, including the type of crops grown, the geographical area, and the risks associated with the farming season. Here’s what farmers should consider:

- Type of Crop: Different crops are vulnerable to different risks. For example, wheat may be more affected by drought, while rice is more sensitive to floods.

- Geographical Factors: Farmers in flood-prone areas may benefit more from policies that focus on natural disaster coverage.

- Policy Customization: Many insurance providers offer customizable plans, allowing farmers to add riders for specific risks like pest infestations or machinery breakdown.

By carefully evaluating these factors, farmers can choose a policy that provides the most comprehensive protection.

8. Government Schemes Supporting Agriculture Insurance in India

The Indian government has introduced several schemes to support agriculture insurance, making it more accessible to farmers across the country. Some of the prominent schemes include:

- Pradhan Mantri Fasal Bima Yojana (PMFBY): This scheme provides affordable crop insurance to farmers, covering risks like drought, floods, and pests.

- Restructured Weather-Based Crop Insurance Scheme (RWBCIS): This program compensates farmers based on weather conditions such as rainfall and temperature.

- Livestock Insurance Scheme: Protects farmers from financial losses due to the death of livestock like cattle and goats.

These government schemes play a vital role in ensuring that farmers can afford the protection they need for their crops and livestock.

9. The Role of Agriculture Insurance in Protecting Farmers’ Livelihood

Agriculture insurance is not just about protecting crops or livestock; it’s about safeguarding a farmer’s livelihood. For many farmers, one bad season can wipe out their entire income and push them into debt. Agriculture insurance acts as a buffer, helping them recover from losses and continue farming without severe financial strain. It provides the confidence farmers need to invest in better seeds, fertilizers, and technology, knowing that their risks are covered.

FAQs: Farmers’ Questions About Agriculture Insurance Answered

- Ramesh from Punjab asks:

Can I get agriculture insurance for my livestock as well as my crops?

Yes, you can. There are specific agriculture insurance policies that cover both crops and livestock. Crop insurance typically provides protection against natural calamities such as floods, droughts, and pest infestations, while livestock insurance covers losses due to the death or illness of animals like cattle, goats, or sheep. This combined coverage ensures that both aspects of your farming are protected, giving you peace of mind and financial security. - Anita from Maharashtra asks:

Is it necessary to take agriculture insurance every season?

Yes, it is highly recommended to take agriculture insurance every season. Farming is subject to various risks, and these risks fluctuate with seasons. For example, the monsoon season may bring risks of flooding or crop diseases, while the winter months might cause cold stress in livestock. Renewing your insurance policy each season ensures that your crops and livestock are protected throughout the year, especially during high-risk periods. - Rahul from Uttar Pradesh asks:

What is the premium amount for agriculture insurance?

The premium for agriculture insurance depends on several factors, including the type of crop or livestock, the geographical location, the size of the farm, and the risks covered. Government schemes like the Pradhan Mantri Fasal Bima Yojana (PMFBY) offer subsidized premiums to make insurance affordable for all farmers. On average, farmers pay 2-5% of the sum insured for their crops, with the government covering a significant portion of the premium. - Pooja from Rajasthan asks:

Can agriculture insurance cover market price fluctuations?

Yes, some specialized insurance policies or schemes provide coverage for market price fluctuations. These policies compensate farmers if the selling price of their produce drops below the expected market value. This coverage is especially beneficial for farmers who face uncertainty in the selling price of crops due to market volatility. Government schemes like the Price Support Scheme (PSS) also help mitigate the impact of fluctuating market prices. - Suresh from Tamil Nadu asks:

What types of damages are not covered under agriculture insurance?

While agriculture insurance covers a broad range of risks, there are certain exclusions. Common exclusions include damages due to intentional negligence, losses from illegal farming practices, or damages caused by war or radiation. Additionally, damage occurring before the policy coverage starts or losses resulting from poor farming practices (such as overuse of pesticides or lack of irrigation) are not covered. - Neha from Madhya Pradesh asks:

How do I file an agriculture insurance claim if my crops are damaged?

Filing an agriculture insurance claim is straightforward. Here are the steps:- Notify your insurer or the government scheme representative immediately after the damage occurs.

- Submit a claim form along with proof of the damage (photos of the affected crops, a damage report, etc.).

- An inspector from the insurance company will visit your farm to assess the damage.

- After the inspection, your claim will be processed, and compensation will be transferred directly to your bank account. It’s crucial to report the damage within the stipulated time frame to avoid claim rejection.

- Karan from Gujarat asks:

How does the Pradhan Mantri Fasal Bima Yojana (PMFBY) help farmers?

The PMFBY is a government-backed agriculture insurance scheme designed to protect farmers from financial losses due to crop failure caused by natural disasters, pests, or diseases. Under this scheme, farmers can insure their crops at a very low premium, with the government covering the rest. The scheme provides comprehensive coverage, including pre-sowing and post-harvest losses, ensuring farmers are protected throughout the farming cycle. - Vivek from Haryana asks:

What is the role of the insurance company in protecting farmers’ crops?

Insurance companies play a critical role in protecting farmers’ crops by providing financial compensation when losses occur due to unforeseen events. They assess the risks, calculate premiums, and ensure that claims are processed quickly when farmers face damages. Moreover, insurance companies often collaborate with government schemes to offer affordable coverage, making insurance more accessible to small and marginal farmers. - Manju from Karnataka asks:

Can I insure high-value crops like fruits and vegetables?

Yes, high-value crops such as fruits, vegetables, and spices can be insured under horticulture insurance policies. These crops are often more susceptible to damage due to their delicate nature, and the financial losses from their destruction can be significant. By insuring high-value crops, farmers can recover a portion of the production costs in case of damage from weather conditions, pests, or diseases. - Ravi from Bihar asks:

How soon will I receive compensation after filing an agriculture insurance claim?

Once you file an insurance claim and the inspection is complete, the compensation process typically takes 2 to 4 weeks. The insurance company will verify the claim, assess the damage, and calculate the payout based on your policy coverage. For faster claims processing, it’s essential to ensure all necessary documents are submitted and any requested inspections are completed promptly.